Take Control of Your Financial Future

And Build the Life You Have Always Dreamed Of

Welcome to the RLT Newsletter

Helping Everyday Traders Beat the Market with Practical, Realistic Strategies

At the RLT Newsletter, our mission is simple: to educate and empower ordinary people to take control of their financial futures and manage their investments with confidence. We strive to help regular individuals like you invest and protect their hard-earned money to build a better life for themselves and their families.

Whether you're a beginner or a seasoned investor, our rules-based systems and clear analysis are designed to help you grow your wealth effectively—while giving you more time to focus on what truly matters in your life.

Struggling with Time, Knowledge, or Consistency?

Do you view investing as something that takes too much time, costs too much money, or feels too overwhelming to tackle on your own?

Maybe you can’t find the time to create trading plans, run scans, or set up alerts.

Are consistency and discipline your biggest hurdles, making it hard to stick to and follow a plan?

If this resonates with you,

The RLT Newsletter is here to help.

Our expert market analysis and proven, rules-based trading systems empower you to approach the stock market with confidence, discipline, and clarity. It’s time to overcome the challenges holding you back, face the market head-on, and come out victorious. The stock market is the best wealth creation device known to man and it’s time for you to start actively participating in it. Let us help you thrive!

Join the RLT Newsletter today to take back your time and secure your financial future.

Just $708 /YR

BLACK FRIDAY SPECIAL

$500/YR

**No Refunds on Annual Subscriptions

Your Success, Our Mission: Empowering You to Win in the Market

Let Us Help You Succeed

Stay Informed: Receive 4 emails per week with market news and key price updates.

Follow Proven Systems:

Gain access to 4 live trading portfolios, updated in real-time.

Save Time:

Make adjustments to your portfolio in just minutes each day.

Gain Confidence: Learn from clear, concise charts and expert analysis tailored for all skill levels.

Master the Market:

Dive deep into technical analysis with insights on gap dynamics, macro trends, Fibonacci retracements, and Elliott Wave theory.

At Real Life Trading, we understand the challenges you’re facing, whether you’re just starting out or trying to break through to consistent profitability.

WHAT'S INCLUDED WITH THE RLT NEWSLETTER:

4 live trading portfolios:

Long-term Swing Trading

Long-term Investing

Momentum Trading

Short-term trading

4 weekly newsletters with trade alerts, stock picks, and market insights.

A weekly video featuring market rundowns and top stocks to watch.

On-demand support from an expert team of investors.

Portal access to track all actively managed portfolios.

Slack access to engage daily with our market analysts and the community.

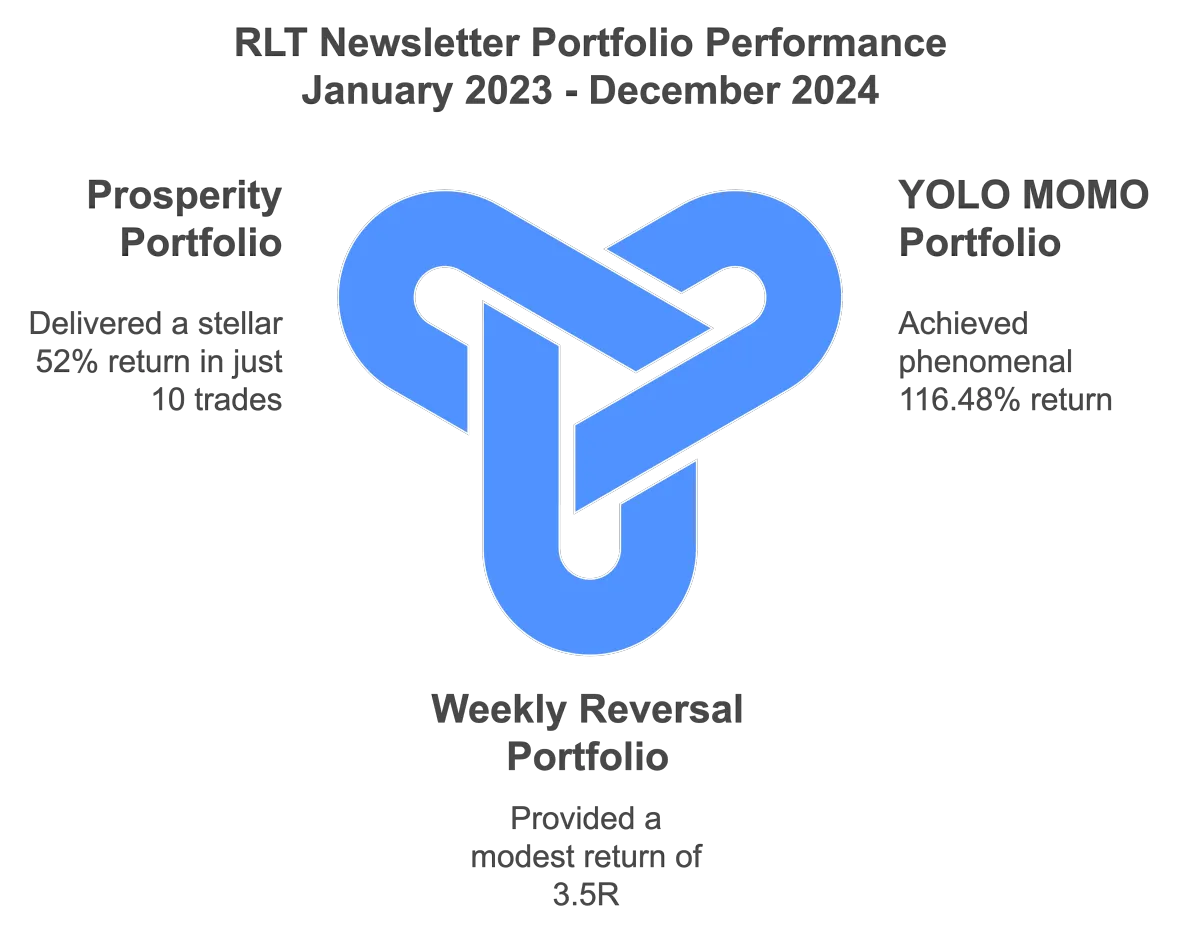

Our Momentum Trading plan gets you exposure to the strongest stocks on the planet and helps you ride them higher for serious profits.

Our Prosperity Portfolio helps traders beat the market with just a few trades each year while managing downside risk. This slow and steady system is perfect for retirement accounts, long term trading accounts or anyone who wants amazing returns with very little time commitment.

Choose Excellence, Choose Results: Here’s Why We’re Your Best Bet

Our Promise to You

The Real Life Trading Newsletter stands apart from other financial publications by embracing a rules-based approach to the market and offering a genuine and realistic approach to the realities of trading. We recognize that trading entails both wins and losses, which is why we provide our members with straightforward, realistic expectations. Our commitment to transparency and authenticity combined with our sincere desire to empower our subscribers to reach their financial goals is what sets us apart. Join us as we take our trading skills and our trading accounts to the next level.

Just $708 /YR

BLACK FRIDAY SPECIAL

$500/YR

***No Refunds on Annual Subscriptions

Don't Just Take Our Word For It...

Here's What Others Have To Say

Emails That Grow Your Wealth: How the RLT Newsletter Boosts Your Retirement Account and More

"Do you like "Mailbox Money"? What about great trade setups and ideas delivered straight to your email a few times a week? If your answer is yes, then you need to sign up for the RLT Newsletter. The YOLO MOMO and Prosperity Portfolio setups have been crushing the returns this year while managing risk. And every Tuesday, I get a video with some amazing chart analysis and trade ideas. My retirement account just keeps growing and it is all thanks to the RLT Newsletter!”

-Jason K.

From Confidence to Cash Flow: How the RLT Newsletter Transformed My Trading

"The RLT Newsletter is a great combination of technical analysis, trade ideas, and portfolio management. Both Yates and Jerremy are master technicians. I use the RLT Newsletter for short-term swing trade ideas and to practice my technical analysis. The Newsletter has increased my monthly cash flow, and it has given me the confidence to make my own trades based on the technical analysis provided. This Newsletter is an amazing value for the price. Highly recommended!”

-Chris W.

A Lifesaver for Busy Traders: How the RLT Newsletter Makes Every Hour Count

"I just can't stress enough how much I love your newsletters and how grateful I am for them. For a full time worker like myself that only has 1 hour a day to work on trading, it's a life saver! Thank you for all your time and effort putting them together!”

-Christopher W.

Finding the Perfect Fit: How the RLT Newsletter and Community Inspire Growth and Impact

"The RLT newsletter has been the right fit for me in the RLT community! I am hoping to continue to find ways to evolve, get more involved and use this education to change lives. Love your mission and the community of helpful people."

-Brian H.

Take the guesswork out of trading.

Gain the tools, insights, and support you need to succeed in the markets.

Just $708 /YR

BLACK FRIDAY SPECIAL

$500/YR

***No Refunds on Annual Subscriptions

Frequently Asked Questions

How many emails will I receive each week?

You’ll receive 4 regular weekly emails on Monday, Tuesday, Thursday, and Friday. Additionally, you’ll receive occasional emails with portfolio updates as needed.

Can I cancel my monthly subscription anytime?

Yes! If you’re on the $59 monthly plan, you can cancel anytime, and your subscription will continue through the end of your current billing period.

Are the RLT Newsletter portfolios traded with live money?

No, all four RLT Newsletter portfolios are tracked in a simulated, paper trading account for educational and entertainment purposes only. Our goal is to teach traders how to manage risk and their own portfolios effectively. We are stock market educators, not financial advisors. If you need personalized financial advice, we strongly encourage you to consult a qualified financial professional.

Do the RLT Newsletter analysts take all the trades in the portfolios?

No, the analysts do not personally take every trade in the portfolios.

Are the stocks reviewed in the Tuesday Top Trade Video part of the 4 portfolios?

Not necessarily. While active or prospective trades for the portfolios may occasionally be discussed, the majority of the video focuses on general market reviews and stock charts that appear interesting from a technical analysis perspective.

What is the Prosperity Portfolio?

The Prosperity Portfolio is a long-term swing trading system that focuses exclusively on the QQQ. This long-only strategy aims to outperform the market by staying out during bearish periods and remaining invested during bullish trends. Unlike traditional buy-and-hold strategies, it actively manages downside risk, making it ideal for long-term investors seeking steady growth with reduced volatility. With only a handful of trades each year, it’s a time-efficient resource for those who want to grow their portfolio without the need for frequent trading.

What is the YOLO MOMO Portfolio?

YOLO, short for “you only live once,” paired with MOMO, short for “momentum,” defines the essence of the YOLO MOMO Portfolio. This momentum-driven, aggressive swing trading strategy focuses on capturing significant moves in the market’s strongest-performing tech stocks. With an emphasis on relative strength and excellent risk-reward setups, this system offers the potential for outsized returns. It comes with high volatility and large portfolio swings, making it an ideal resource for traders seeking aggressive growth and who are comfortable taking on higher levels of risk.

What is the RL Swing Stalker Portfolio?

The RL Swing Stalker Portfolio is a short-term swing trading system that leverages advanced market scans to uncover opportunities. Using the R system for precise risk management, this strategy takes both bullish and bearish trades to maximize profit potential. It’s an ideal resource for active traders looking for a system with well-defined risk parameters and frequent trading opportunities.

What is the HODL Hero’s Portfolio?

The HODL Hero’s Portfolio is a long-term investing strategy aimed at achieving substantial returns by holding high-quality stocks for extended periods. Risk is managed using advanced options strategies. This long-term portfolio does not use the R system for risk management, meaning it can experience larger drawdowns. This portfolio is a resource for long term investors focused on long-term growth and who are willing to embrace more volatility.

DISCLAIMER - PLEASE READ BEFORE MAKING ANY RLT NEWSLETTER TRADES

Disclaimer: Each portfolio in the RLT Newsletter is a hypothetical paper trading account. Real Life Trading and its analysts use these portfolios as an educational tool. It’s important to note that Real Life Trading nor its analysts are actively managing live, real-money portfolios. The analysts and moderators may or may not trade any of the given equities.

CFTC Rule 4.41: These results are based on hypothetical or simulated performance results with inherent limitations. Unlike actual performance records, these results do not represent real trading. Because these trades haven't been executed, the results may have under- or over-compensated for the impact of certain market factors, such as the lack of liquidity. Hypothetical or simulated trading programs are designed with the benefit of hindsight, and no representation is being made that any account will or is likely to achieve profits or losses similar to those shown.

Trading Risks: Real Life Trading LLC (“Company”) is not an investment advisory service, nor a registered investment advisor or broker-dealer and does not purport to tell or suggest which securities customers should buy or sell for themselves. The independent contractors, employees or affiliates of Company may hold positions in the stocks, options, currencies or industries discussed here. You understand and acknowledge that there is a very high degree of risk involved in trading securities, options and/or currencies. The Company assumes no responsibility or liability for your trading and investment results. It should not be assumed that the methods, techniques, or indicators presented will be profitable or that they will not result in losses. Past results of any individual trader or trading system presented by the Company are not indicative of future returns by that trader or system, and are not indicative of future returns which will be realized by you. In addition, the indicators, strategies, and all other features of Company’s products (collectively, the “Information”) are provided for informational and educational purposes only and should not be construed as investment advice.

MONEY MAKING BLOGS

Market Milestones: So Many Options!

Last week was marked by selling, and this week, the markets have been retesting last week’s bearish candle. The SPY, QQQ, DIA, and IWM have all retested the 50% level of last week’s bearish candle as of Thursday night. Zooming into the daily chart, the SPY and QQQ retested the Trump election retest gap and are now bouncing after bulls held firm to that support. As long as last Friday’s low holds, we can expect a further grind up into new highs. However, if the markets start breaking below last Friday’s low, we could see additional selling heading into December. In that scenario, the $565.00 level and the 100-day SMA on SPY should act as strong support and provide a good buying opportunity.

SPY

The exuberance in the stock market is palpable right now, but it pales in comparison to the sheer euphoria in the crypto space. By the time you’re reading this, Bitcoin may have already hit the $100,000 mark—an incredible, some would say inevitable, milestone. However, many thought this big moment would happen during the last cycle before Bitcoin peaked at $69,000 and plummeted 77% into a long crypto winter.

Looking at past cycles, it’s clear that large drawdowns during the strongest parts of bull runs are normal. However, history also shows that Bitcoin can run higher and longer than most expect before these corrections occur.

2012 Cycle: Bitcoin experienced a massive parabolic move followed by an 80% drawdown, resembling a mini-cycle within the broader cycle. After breaking out again in October 2013, Bitcoin saw two 25% drawdowns and one 50% drawdown before peaking in December 2013. The first bull run in the 2012 cycle lasted 13 weeks, while the second lasted 7 weeks.

2017 Cycle: Following the breakout from the “Post-Halving Accumulation Zone,” Bitcoin endured five drawdowns of over 30%, each lasting 2–5 weeks. This "Post-Halving Party Zone" spanned 50 weeks before peaking.

2020 Cycle: There was only one significant drawdown, occurring 12 weeks into the post-halving rally. Many argue that the true cycle top occurred in April, as the truncated November peak was part of the broader correction. This means that the parabolic bull run lasted about 25 weeks.

This history highlights Bitcoin’s tendency to rally vertically for months with minimal pullbacks, creating intense FOMO and reinforcing the “buy high and sell higher” mentality in new traders—until the inevitable cycle shift leaves them rekt. At just three weeks into the current “Post-Halving Party Zone,” the rally may feel extended but could continue longer than many anticipate.

Now that we have discussed bitcoins proclivity for leaving everyone in the dust, let’s review some signals that may give potential buyers some hope. The following are signals that a pullback or retest could occur within the next six weeks, providing latecomers a better entry point:

For those hoping for an entry or a chance to add to their positions, here are some potential signals that a pullback or retest may occur before year end:

$100,000 milestone: This psychologically significant level is a logical profit-taking zone for many investors.

SOL at all-time highs: Solana, one of the strongest altcoins, is hitting a key resistance zone, at its previous all-time high of $260.00.

ETH resistance: Ethereum, while underperforming (still 30% off its all-time highs), is approaching its bearish trendline resistance that has held since March of this year.

Elliot Wave: The Elliot Wave pattern we are tracking on Bitcoin has us completing wave 3 of a larger wave 3. This means that 4th wave correction needs to happen before the next big push higher on Bitcoin That said, Bitcoin's 5th waves are notorious for extending, so this correction could be delayed.

BTCUSD

Before we dive into the exciting news for this week, let’s address an important topic in crypto: taking profits in crypto always makes you feel silly and wrong. You’ll never sell at the absolute top, and prices often go higher, sometimes much higher, after you exit. However, if you’re trading, profit-taking is an essential part of the equation. Accept now that you won’t perfectly time the top, and instead, embrace the wealth crypto has helped you create by taking risk off the table. To combat FOMO, let partials ride so you can still participate in further upside.

If you’re committed to HODLing, ideally, you were accumulating throughout 2022 and 2023—or even in 2024 when Bitcoin consolidated in a fourth wave for eight straight months. That low dollar-cost average provides plenty of breathing room to weather larger drawdowns. Just remember, HODLing altcoins is a quick way to crater your portfolio. Stick with the "big daddy" of the crypto world—the tried and true Bitcoin.

In an exciting development for Bitcoin, IBIT (BlackRock’s Bitcoin ETF) launched options trading on Tuesday. They introduced weekly options for Bitcoin on Thursday, giving investors so many more options for their crypto investing strategy. On launch day, I sold December $45 puts for $0.90—a 2% return for one month and 15% below the current price. That’s incredible, especially since selling puts on up days isn’t the smartest thing to do. Imagine the juicy premiums we will see on down days! Of course, selling puts means you must be ready to purchase the stock and the risk on getting assigned with an asset like Bitcoin is especially high.

The options chain on IBIT is by far the best and will continue to be the best as IBIT is the dominant ETF in the space. For this reason, I am sticking to IBIT for any and all bitcoin ETF plays. This is yet another massive step forward for the crypto space. Exciting news for bitcoin is coming at us so fast—it’s hard to keep up!

IBIT

Speaking of options, have you checked out MSTR lately? Things are absolutely wild. As you may have heard, MicroStrategy is executing a Bitcoin treasury strategy where they are selling shares of MSTR to finance huge Bitcoin purchases. Short sellers were squeezed to death all week as MSTR ripped higher moving over 60% from this Mondays low to Thursday’s high. On Thursday, MSTR printed a $173 candle, as selling finally kicked in and MSTR plummeted.

During this drop options premiums went through the roof. The expected move over the next two weeks is $200—on a $400 stock! At one-point Thursday, the $280 strike (two weeks out) was paying $26.00, nearly a 10% return for two weeks at 25% below the current price! For context, a “good” benchmark is 1% per four weeks on a put sale. If you’re selling these puts, be prepared to own those shares because anything can happen.

MSTR

Market Milestones: So Many Options!

Last week was marked by selling, and this week, the markets have been retesting last week’s bearish candle. The SPY, QQQ, DIA, and IWM have all retested the 50% level of last week’s bearish candle as of Thursday night. Zooming into the daily chart, the SPY and QQQ retested the Trump election retest gap and are now bouncing after bulls held firm to that support. As long as last Friday’s low holds, we can expect a further grind up into new highs. However, if the markets start breaking below last Friday’s low, we could see additional selling heading into December. In that scenario, the $565.00 level and the 100-day SMA on SPY should act as strong support and provide a good buying opportunity.

SPY

The exuberance in the stock market is palpable right now, but it pales in comparison to the sheer euphoria in the crypto space. By the time you’re reading this, Bitcoin may have already hit the $100,000 mark—an incredible, some would say inevitable, milestone. However, many thought this big moment would happen during the last cycle before Bitcoin peaked at $69,000 and plummeted 77% into a long crypto winter.

Looking at past cycles, it’s clear that large drawdowns during the strongest parts of bull runs are normal. However, history also shows that Bitcoin can run higher and longer than most expect before these corrections occur.

2012 Cycle: Bitcoin experienced a massive parabolic move followed by an 80% drawdown, resembling a mini-cycle within the broader cycle. After breaking out again in October 2013, Bitcoin saw two 25% drawdowns and one 50% drawdown before peaking in December 2013. The first bull run in the 2012 cycle lasted 13 weeks, while the second lasted 7 weeks.

2017 Cycle: Following the breakout from the “Post-Halving Accumulation Zone,” Bitcoin endured five drawdowns of over 30%, each lasting 2–5 weeks. This "Post-Halving Party Zone" spanned 50 weeks before peaking.

2020 Cycle: There was only one significant drawdown, occurring 12 weeks into the post-halving rally. Many argue that the true cycle top occurred in April, as the truncated November peak was part of the broader correction. This means that the parabolic bull run lasted about 25 weeks.

This history highlights Bitcoin’s tendency to rally vertically for months with minimal pullbacks, creating intense FOMO and reinforcing the “buy high and sell higher” mentality in new traders—until the inevitable cycle shift leaves them rekt. At just three weeks into the current “Post-Halving Party Zone,” the rally may feel extended but could continue longer than many anticipate.

Now that we have discussed bitcoins proclivity for leaving everyone in the dust, let’s review some signals that may give potential buyers some hope. The following are signals that a pullback or retest could occur within the next six weeks, providing latecomers a better entry point:

For those hoping for an entry or a chance to add to their positions, here are some potential signals that a pullback or retest may occur before year end:

$100,000 milestone: This psychologically significant level is a logical profit-taking zone for many investors.

SOL at all-time highs: Solana, one of the strongest altcoins, is hitting a key resistance zone, at its previous all-time high of $260.00.

ETH resistance: Ethereum, while underperforming (still 30% off its all-time highs), is approaching its bearish trendline resistance that has held since March of this year.

Elliot Wave: The Elliot Wave pattern we are tracking on Bitcoin has us completing wave 3 of a larger wave 3. This means that 4th wave correction needs to happen before the next big push higher on Bitcoin That said, Bitcoin's 5th waves are notorious for extending, so this correction could be delayed.

BTCUSD

Before we dive into the exciting news for this week, let’s address an important topic in crypto: taking profits in crypto always makes you feel silly and wrong. You’ll never sell at the absolute top, and prices often go higher, sometimes much higher, after you exit. However, if you’re trading, profit-taking is an essential part of the equation. Accept now that you won’t perfectly time the top, and instead, embrace the wealth crypto has helped you create by taking risk off the table. To combat FOMO, let partials ride so you can still participate in further upside.

If you’re committed to HODLing, ideally, you were accumulating throughout 2022 and 2023—or even in 2024 when Bitcoin consolidated in a fourth wave for eight straight months. That low dollar-cost average provides plenty of breathing room to weather larger drawdowns. Just remember, HODLing altcoins is a quick way to crater your portfolio. Stick with the "big daddy" of the crypto world—the tried and true Bitcoin.

In an exciting development for Bitcoin, IBIT (BlackRock’s Bitcoin ETF) launched options trading on Tuesday. They introduced weekly options for Bitcoin on Thursday, giving investors so many more options for their crypto investing strategy. On launch day, I sold December $45 puts for $0.90—a 2% return for one month and 15% below the current price. That’s incredible, especially since selling puts on up days isn’t the smartest thing to do. Imagine the juicy premiums we will see on down days! Of course, selling puts means you must be ready to purchase the stock and the risk on getting assigned with an asset like Bitcoin is especially high.

The options chain on IBIT is by far the best and will continue to be the best as IBIT is the dominant ETF in the space. For this reason, I am sticking to IBIT for any and all bitcoin ETF plays. This is yet another massive step forward for the crypto space. Exciting news for bitcoin is coming at us so fast—it’s hard to keep up!

IBIT

Speaking of options, have you checked out MSTR lately? Things are absolutely wild. As you may have heard, MicroStrategy is executing a Bitcoin treasury strategy where they are selling shares of MSTR to finance huge Bitcoin purchases. Short sellers were squeezed to death all week as MSTR ripped higher moving over 60% from this Mondays low to Thursday’s high. On Thursday, MSTR printed a $173 candle, as selling finally kicked in and MSTR plummeted.

During this drop options premiums went through the roof. The expected move over the next two weeks is $200—on a $400 stock! At one-point Thursday, the $280 strike (two weeks out) was paying $26.00, nearly a 10% return for two weeks at 25% below the current price! For context, a “good” benchmark is 1% per four weeks on a put sale. If you’re selling these puts, be prepared to own those shares because anything can happen.

MSTR

ABOUT REAL LIFE TRADING

We are a stock trading education company. Our goal is to teach and empower people to create generational wealth to enrich their lives and communities.

ONLINE TRAINING LINKS