START TRADING WITH CONFIDENCE

JOIN A COMMUNITY COMMITTED TO YOUR SUCCESS

Are you new to trading and ready to make your mark? Or do you have experience but are struggling to become a consistently profitable trader?

Imagine having a community of like-minded traders and experts at your side, helping you navigate every step of the journey!

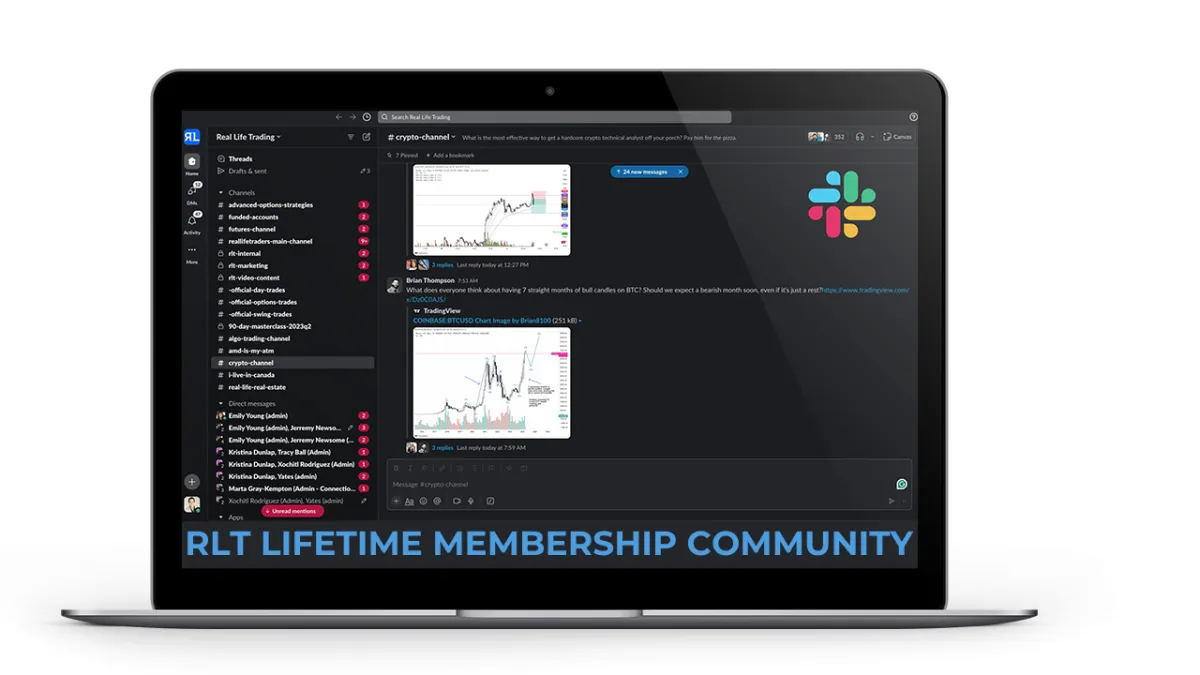

Join us and gain lifetime access to our exclusive Slack community—where you’ll find real-time support, valuable insights, and camaraderie with fellow traders. With FREE monthly courses and weekly live education sessions, we’re here to guide you every step of the way. Whether you're just starting out or looking to enhance your skills, you’ll have the tools and community you need to trade with confidence.

Start your journey today with a community dedicated to your success with a one-time $25 investment!

CREATE CASH FLOW AND KEEP IT

RETIRE EARLY AND LIVE THE LIFE YOU WANT

We teach people how to make money from the stock and crypto markets and KEEP IT by following simple and proven strategies that have generated $10,000,000+ for our customers and their families.

Tired of working for someone else? Dream of trading full-time?

Now’s your chance to make it happen!

Become a Full-Time Trader in 2025 with Tony Pawlak's

Elite 10-Month Premier Coaching Program !

Registration Only Opened Once a Year!

This isn’t just another program —

it’s a proven pathway to success. Over the years, Tony has helped countless students quit their jobs and transition into full-time trading. Through personalized coaching and hands-on training, he will guide you step by step to ensure you not only learn, but master the essential skills needed to consistently win in the markets.

AS FEATURED IN

Want to Trade LIVE with other TRADERS?

Get signed up for our immersive, high-energy, active stock trading rooms.

You'll get detailed insights on entries, exits, targets, and explanations.

We answer viewer questions in real time.

Get All Access to All Live Trading Rooms + Slack + RLT Newsletter

Just $275/Month - Best Value

Real-time trades you can follow

Exclusive Weekly Mentorships

Expert 1:1 trading support on demand

Access to a private slack group

Access to an incredible community of RLT traders to support you on your journey

Get access to live day trade & swing trading rooms

Live practice sessions/drills and strategies + get real-time feedback

Live market recaps and analysis

Weekly Q&A session to review your trades and answer your trading questions.

RLT Newsletter with trade alerts, stock picks and market analysis

Live Day Trading Room

Just $179/Month

Real-time trades you can follow

Expert 1:1 trading support on demand

Access to an incredible community of RLT traders

Get access to our live day trading room

Live practice sessions/drills and strategies + get real-time feedback

Live market recaps and analysis

Live SWING Trading Room

Just $149/Month

Real-time trades you can follow

Expert 1:1 trading support on demand

Access to an incredible community of RLT traders

Get access to our live swing trading room

Live practice sessions/drills and strategies + get real-time feedback

Live market recaps and analysis

RLT Education Programs

Mentorships

Unlock Your Trading Potential with

Funded Trading

Do you have the skills to trade, but lack the capital to make your mark in the markets?

Funded trading could be the solution you've been waiting for. With funded trading, you can trade with the backing of a funding company who will provide you with the trading capital, allowing you to focus on your strategy without the burden of risking your own capital.

Apex Trader Funding was established in

2021 with the goal of revolutionizing the trader payout model. It was founded out of dissatisfaction with existing funding companies and a desire to adopt a more customer-centric approach. As a premier trader funding company, Apex Trader Funding (ATF) outperforms other futures funding evaluation firms in terms of payouts. With a vast global community spanning over 150 countries and tens of thousands of members, Apex Trader Funding, headquartered in Austin, Texas, specializes in funding evaluations for futures markets.

Receive 100% of the first $25,000 per Account and 90% Beyond That

Two Payouts per Month

Trade Full-Sized Contracts in Evaluations or Funded Accounts

No Scaling or Failing by Going Over Contract Size

No Daily Drawdowns

Trade on Holidays

Trade Your Normal Day-to-Day Strategy or System During The News

No Total Cap on Maximum Payout

One-Step Evaluation Process

Real-Time Data Included

Simple Risk Management Rules

Trade With Multiple Accounts up to 20 max

If you’re a trader with the knowledge and skill but are held back by limited capital, Apex Trader Funding offers you the chance to access the capital you need to trade confidently.

Join the revolution in trading today with Apex Trader Funding, where your potential is funded, and your success is our priority.

FREE TRADING RESOURCES

Take FREE online courses to learn how to earn extra income while keeping your day job, Paying off debt, investing in your future, and Retiring Early

BEGINNER GUIDE TO DAY TRADING COURSE

FREE

BEGINNER GUIDE TO SWING TRADING COURSE

FREE

BEGINNER GUIDE TO INVESTING COURSE

FREE

GET TRADE ALERTS

Just $59/Month

Are you unable to find the time to build your own trading plans, do your own scans, or set up your own alerts? If so, our systems have you covered. Seize this opportunity to establish yourself as a consistent and disciplined trader and grow your trading account. Begin your journey today by subscribing to the RLT Newsletter.

MONEY MAKING BLOGS

Market Milestones: Bitcoin Bull Market Support

It’s been a few weeks since my last bitcoin write-up, which means it’s time to revisit the chart. I’ve been doing these more often lately because of the elevated risks I see in this incredible asset, and I want everyone to be aware of them. Right now, there are several key levels worth paying close attention to and we will discuss them today in depth. Recently I reviewed bitcoin’s correlations with M2 money supply, the DXY, equities, and the Elliott Wave counts—all of which suggest upside but also warned that we could be nearing the end of this bull market.

As of the most recent all-time high, one Elliott Wave count is now complete and suggests the top may already be in. We’re also seeing a bull trap and double top pattern similar to the one that marked the end of the 2021 cycle. In this cycle, every bull trap has triggered at least a 22% drawdown, which would pull price back to the 50-week EMA—a level that has consistently acted as a key bull market support. The only moving average I’ve found to be slightly more reliable is the 100-SMA on the 3-day chart. Currently, the 50-week EMA is near $95,000, while the 100-SMA on the 3D chart sits around $100,400. Bitcoin has held above both since early 2023, when it finally reclaimed them after nearly a year-long bear market.

BTC 3 Day Chart

September has historically been a weak month for BTC, and this one is setting up no differently. The current double top is playing out with a clean neckline retest on September 3rd. The double top measured move targets the $95k–$100k range. This is where multiple supports converge: the 50-week EMA, the 100-SMA on the 3D chart, the YTD anchored VWAP, and the cycle trendline that has held this entire bull market.

As I’ve said before, there are still plenty of reasons to expect higher prices—after all, the September lull has historically set the stage for the next leg to new all-time highs. That said, price action remains the ultimate judge. If bitcoin starts closing below the 50-week EMA, the 100-SMA on the 3-day chart, and that trendline support, the odds of a deeper bearish shift rise sharply. Quick wicks below key levels are normal—bitcoin often flushes lower in liquidity sweeps before snapping back, shaking out leveraged traders along the way. The critical point for the bulls is that bitcoin must reclaim these supports quickly whenever they’re broken.

Should we see a decisive close below $95,000, one last key level comes into play: the 20-month EMA. This moving average has historically defined bull vs. bear cycles and currently sits around $85,000. That means BTC could drop about 30% from its ATH and still technically remain in a bull market. But if that level breaks, it would “confirm” a bear market as the Elliot Wave counts would also point towards a more bearish outlook at that point. By the time we get to the 20-month EMA, bitcoin would already be well below all major bull market supports, signaling that this bull run is truly over.

For now I still plan on trading bitcoin if it drops back into the major support region of $100,000- $95,000. If we break and close below the 50-week EMA, I will protect and hedge my position. Even though risk is elevated here more than it has been at any time in this cycle since the launch of the ETF’s there still is a decent risk vs reward if BTC drops back into the key support levels. After each post halving September low BTC has rallied strongly into a new all-time high and my targets for that push would be up into the $130,000 or higher range. That gives a 30% upside from the key support levels and is something I plan on at least taking a shot on.

BTC Elliot Wave

Just for fun—since I know many of you are wondering—where do we go if bitcoin breaks below all the key supports we just covered? The truth is no one knows, and countless factors can shape where the eventual bottom lands. That said, there are a few signals I always monitor closely. The first is RSI. As many of you know, I have a rule: when daily RSI hits 27 I buy for my long-term holdings and simply wait for new highs. During the last bear market, this signal only triggered three times before the final bottom which also gave a buy signal. These bear market entries broke even within a year, and today the average cost of those buys is up over 300%.

BTC Oversold Daily RSI

To help identify the major bear market cycle bottom—not just the short-term lows flagged by the daily RSI—I zoom out to the monthly RSI. A dip into the 40s on the monthly has historically been a strong signal that a cycle bottom is approaching. Another thing I track closely is the massive parallel channel bitcoin has traded in since 2017. The midline of that channel has acted as a strong resistance this entire bull run, which gives even more confirmation that the channel is important. Unless BTC breaks through that midline with conviction and volume, I’ll assume it remains resistance for the rest of this bull run. Currently, the lower boundary of the channel is near $50,000, though that level will rise over time and it would take time to get down there. If bitcoin pushes into the $130,000–$150,000 range over the next several months, that lower trendline will climb to $70,000 or higher.

Historically, bear markets have taken about a year to play out, with drops as deep as 80%. I don’t expect that extreme of a drop this cycle given institutional adoption and the presence of ETFs, but nothing is impossible—especially if a large holder like MSTR were forced to sell. Still, since ETFs launched over 600 days ago, bitcoin’s chart behavior has changed: price has advanced in a more controlled, though still volatile (by equity standards), manner. I expect that same dynamic to mute the downside volatility as well.

Market Milestones: Bitcoin Bull Market Support

It’s been a few weeks since my last bitcoin write-up, which means it’s time to revisit the chart. I’ve been doing these more often lately because of the elevated risks I see in this incredible asset, and I want everyone to be aware of them. Right now, there are several key levels worth paying close attention to and we will discuss them today in depth. Recently I reviewed bitcoin’s correlations with M2 money supply, the DXY, equities, and the Elliott Wave counts—all of which suggest upside but also warned that we could be nearing the end of this bull market.

As of the most recent all-time high, one Elliott Wave count is now complete and suggests the top may already be in. We’re also seeing a bull trap and double top pattern similar to the one that marked the end of the 2021 cycle. In this cycle, every bull trap has triggered at least a 22% drawdown, which would pull price back to the 50-week EMA—a level that has consistently acted as a key bull market support. The only moving average I’ve found to be slightly more reliable is the 100-SMA on the 3-day chart. Currently, the 50-week EMA is near $95,000, while the 100-SMA on the 3D chart sits around $100,400. Bitcoin has held above both since early 2023, when it finally reclaimed them after nearly a year-long bear market.

BTC 3 Day Chart

September has historically been a weak month for BTC, and this one is setting up no differently. The current double top is playing out with a clean neckline retest on September 3rd. The double top measured move targets the $95k–$100k range. This is where multiple supports converge: the 50-week EMA, the 100-SMA on the 3D chart, the YTD anchored VWAP, and the cycle trendline that has held this entire bull market.

As I’ve said before, there are still plenty of reasons to expect higher prices—after all, the September lull has historically set the stage for the next leg to new all-time highs. That said, price action remains the ultimate judge. If bitcoin starts closing below the 50-week EMA, the 100-SMA on the 3-day chart, and that trendline support, the odds of a deeper bearish shift rise sharply. Quick wicks below key levels are normal—bitcoin often flushes lower in liquidity sweeps before snapping back, shaking out leveraged traders along the way. The critical point for the bulls is that bitcoin must reclaim these supports quickly whenever they’re broken.

Should we see a decisive close below $95,000, one last key level comes into play: the 20-month EMA. This moving average has historically defined bull vs. bear cycles and currently sits around $85,000. That means BTC could drop about 30% from its ATH and still technically remain in a bull market. But if that level breaks, it would “confirm” a bear market as the Elliot Wave counts would also point towards a more bearish outlook at that point. By the time we get to the 20-month EMA, bitcoin would already be well below all major bull market supports, signaling that this bull run is truly over.

For now I still plan on trading bitcoin if it drops back into the major support region of $100,000- $95,000. If we break and close below the 50-week EMA, I will protect and hedge my position. Even though risk is elevated here more than it has been at any time in this cycle since the launch of the ETF’s there still is a decent risk vs reward if BTC drops back into the key support levels. After each post halving September low BTC has rallied strongly into a new all-time high and my targets for that push would be up into the $130,000 or higher range. That gives a 30% upside from the key support levels and is something I plan on at least taking a shot on.

BTC Elliot Wave

Just for fun—since I know many of you are wondering—where do we go if bitcoin breaks below all the key supports we just covered? The truth is no one knows, and countless factors can shape where the eventual bottom lands. That said, there are a few signals I always monitor closely. The first is RSI. As many of you know, I have a rule: when daily RSI hits 27 I buy for my long-term holdings and simply wait for new highs. During the last bear market, this signal only triggered three times before the final bottom which also gave a buy signal. These bear market entries broke even within a year, and today the average cost of those buys is up over 300%.

BTC Oversold Daily RSI

To help identify the major bear market cycle bottom—not just the short-term lows flagged by the daily RSI—I zoom out to the monthly RSI. A dip into the 40s on the monthly has historically been a strong signal that a cycle bottom is approaching. Another thing I track closely is the massive parallel channel bitcoin has traded in since 2017. The midline of that channel has acted as a strong resistance this entire bull run, which gives even more confirmation that the channel is important. Unless BTC breaks through that midline with conviction and volume, I’ll assume it remains resistance for the rest of this bull run. Currently, the lower boundary of the channel is near $50,000, though that level will rise over time and it would take time to get down there. If bitcoin pushes into the $130,000–$150,000 range over the next several months, that lower trendline will climb to $70,000 or higher.

Historically, bear markets have taken about a year to play out, with drops as deep as 80%. I don’t expect that extreme of a drop this cycle given institutional adoption and the presence of ETFs, but nothing is impossible—especially if a large holder like MSTR were forced to sell. Still, since ETFs launched over 600 days ago, bitcoin’s chart behavior has changed: price has advanced in a more controlled, though still volatile (by equity standards), manner. I expect that same dynamic to mute the downside volatility as well.

ABOUT REAL LIFE TRADING

We are a stock trading education company. Our goal is to teach and empower people to create generational wealth to enrich their lives and communities.

ONLINE TRAINING LINKS