START TRADING WITH CONFIDENCE

JOIN A COMMUNITY COMMITTED TO YOUR SUCCESS

Are you new to trading and ready to make your mark? Or do you have experience but are struggling to become a consistently profitable trader?

Imagine having a community of like-minded traders and experts at your side, helping you navigate every step of the journey!

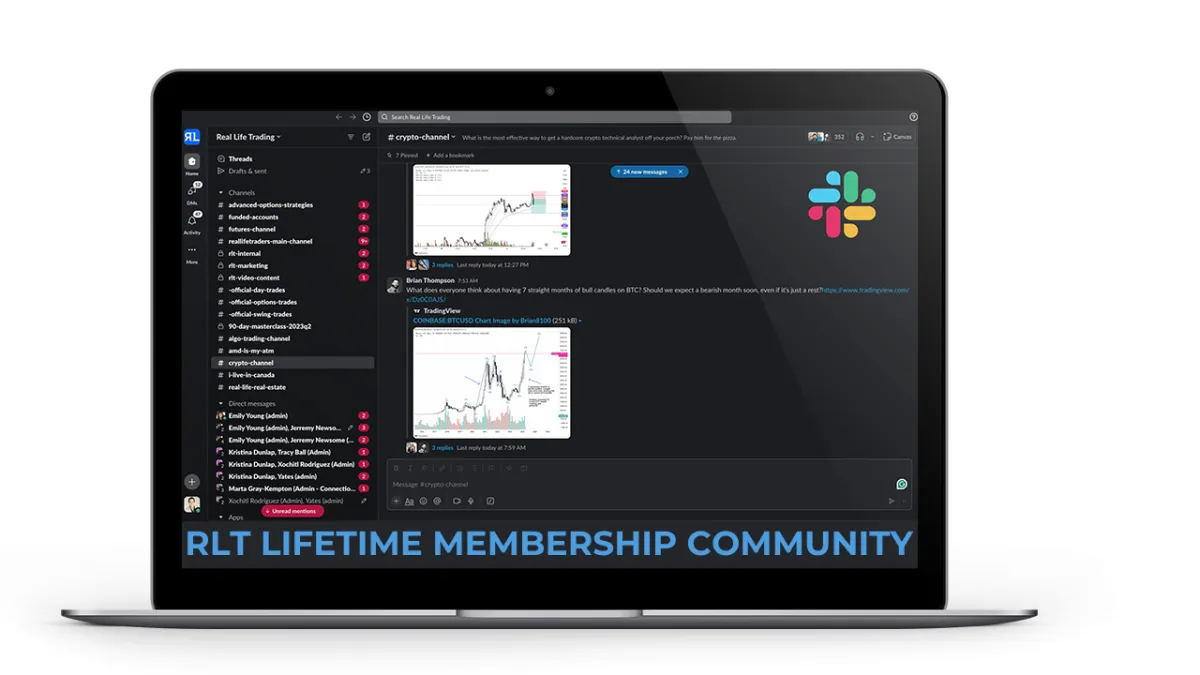

Join us and gain lifetime access to our exclusive Slack community—where you’ll find real-time support, valuable insights, and camaraderie with fellow traders. With FREE monthly courses and weekly live education sessions, we’re here to guide you every step of the way. Whether you're just starting out or looking to enhance your skills, you’ll have the tools and community you need to trade with confidence.

Start your journey today with a community dedicated to your success with a one-time $25 investment!

CREATE CASH FLOW AND KEEP IT

RETIRE EARLY AND LIVE THE LIFE YOU WANT

We teach people how to make money from the stock and crypto markets and KEEP IT by following simple and proven strategies that have generated $10,000,000+ for our customers and their families.

Tired of working for someone else? Dream of trading full-time?

Now’s your chance to make it happen!

Become a Full-Time Trader in 2025 with Tony Pawlak's

Elite 10-Month Premier Coaching Program !

Registration Only Opened Once a Year!

This isn’t just another program —

it’s a proven pathway to success. Over the years, Tony has helped countless students quit their jobs and transition into full-time trading. Through personalized coaching and hands-on training, he will guide you step by step to ensure you not only learn, but master the essential skills needed to consistently win in the markets.

AS FEATURED IN

Want to Trade LIVE with other TRADERS?

Get signed up for our immersive, high-energy, active stock trading rooms.

You'll get detailed insights on entries, exits, targets, and explanations.

We answer viewer questions in real time.

Get All Access to All Live Trading Rooms + Slack + RLT Newsletter

Just $275/Month - Best Value

Real-time trades you can follow

Exclusive Weekly Mentorships

Expert 1:1 trading support on demand

Access to a private slack group

Access to an incredible community of RLT traders to support you on your journey

Get access to live day trade & swing trading rooms

Live practice sessions/drills and strategies + get real-time feedback

Live market recaps and analysis

Weekly Q&A session to review your trades and answer your trading questions.

RLT Newsletter with trade alerts, stock picks and market analysis

Live Day Trading Room

Just $179/Month

Real-time trades you can follow

Expert 1:1 trading support on demand

Access to an incredible community of RLT traders

Get access to our live day trading room

Live practice sessions/drills and strategies + get real-time feedback

Live market recaps and analysis

Live SWING Trading Room

Just $149/Month

Real-time trades you can follow

Expert 1:1 trading support on demand

Access to an incredible community of RLT traders

Get access to our live swing trading room

Live practice sessions/drills and strategies + get real-time feedback

Live market recaps and analysis

RLT Education Programs

Mentorships

Unlock Your Trading Potential with

Funded Trading

Do you have the skills to trade, but lack the capital to make your mark in the markets?

Funded trading could be the solution you've been waiting for. With funded trading, you can trade with the backing of a funding company who will provide you with the trading capital, allowing you to focus on your strategy without the burden of risking your own capital.

Apex Trader Funding was established in

2021 with the goal of revolutionizing the trader payout model. It was founded out of dissatisfaction with existing funding companies and a desire to adopt a more customer-centric approach. As a premier trader funding company, Apex Trader Funding (ATF) outperforms other futures funding evaluation firms in terms of payouts. With a vast global community spanning over 150 countries and tens of thousands of members, Apex Trader Funding, headquartered in Austin, Texas, specializes in funding evaluations for futures markets.

Receive 100% of the first $25,000 per Account and 90% Beyond That

Two Payouts per Month

Trade Full-Sized Contracts in Evaluations or Funded Accounts

No Scaling or Failing by Going Over Contract Size

No Daily Drawdowns

Trade on Holidays

Trade Your Normal Day-to-Day Strategy or System During The News

No Total Cap on Maximum Payout

One-Step Evaluation Process

Real-Time Data Included

Simple Risk Management Rules

Trade With Multiple Accounts up to 20 max

If you’re a trader with the knowledge and skill but are held back by limited capital, Apex Trader Funding offers you the chance to access the capital you need to trade confidently.

Join the revolution in trading today with Apex Trader Funding, where your potential is funded, and your success is our priority.

FREE TRADING RESOURCES

Take FREE online courses to learn how to earn extra income while keeping your day job, Paying off debt, investing in your future, and Retiring Early

BEGINNER GUIDE TO DAY TRADING COURSE

FREE

BEGINNER GUIDE TO SWING TRADING COURSE

FREE

BEGINNER GUIDE TO INVESTING COURSE

FREE

GET TRADE ALERTS

Just $59/Month

Are you unable to find the time to build your own trading plans, do your own scans, or set up your own alerts? If so, our systems have you covered. Seize this opportunity to establish yourself as a consistent and disciplined trader and grow your trading account. Begin your journey today by subscribing to the RLT Newsletter.

MONEY MAKING BLOGS

Market Milestones: Chop-solidation-ways

Sideways consolidation has been the name of the game for the last two weeks. SPY has rejected the key 2015 analog target of $604 twice now and has closed below the 10-day EMA three times since last Friday. That’s notable considering SPY hadn’t even really tested the 10-day EMA—outside of a brief one-day dip on May 23rd—for two months, since the April 23rd gap up.

That said, fading volume, declining momentum, and sideways action don’t automatically mean the market is headed lower. But it usually means you’re closer to a top than a bottom.

Because the market has consolidated at the highs for a bit now, it still has the potential to break out into new all-time highs, trigger FOMO buys at the top, and then roll over—very much like we saw in our 2015 and 2018 analogs. In 2018, we did get that final new high before the sell-off. In 2015, we didn’t. Of course, analogs aren’t perfect playbooks—but they give us a solid framework for what could play out based on historical price action.

SPY broke below its first main support at $600 this week, leaving $595 and $590 as the next key levels to watch. If we start closing below—or especially gapping below—those levels, I’ll lean more confidently toward the start of a real pullback. Until then, I remain cautious-to-neutral.

Yeah, I know—that’s probably the most boring stance to take. But patience during sideways, choppy markets is a critical skill to master. It’s frustrating, it’s boring, but it’s also where a lot of people make unnecessary mistakes. Sit tight, plan, and let the market show its hand.

SPY

Over the last several weeks in this newsletter and in RLT, we’ve been keeping a close eye on small caps—because frankly, that’s where most of the trading action has been. Many of the large caps we follow have already made their big moves.

IWM, in particular, has a pretty clean inverse head and shoulders pattern forming. If it plays out, a move into $220- $225 is very possible—especially if SPY grinds to new highs.

From a risk-management perspective, the setup is actually pretty straightforward. There’s actually a bearish 10-day EMA trade present, and IWM has the 100-day SMA sitting just below. More aggressive traders might choose to manage risk on a close below Wednesday’s candle, the bearish 10-EMA trigger. More conservative traders could use the 100-day SMA (around $206) as their level. If we break below $202.50 and the pink trendline, the immediate bullish thesis is likely invalidated.

IWM

BTC hasn’t given us much to work with over the last month. It’s been consolidating in a tight triangle since hitting its all-time high on May 22nd—which makes sense, considering it ran nearly 50% in just 43 days.

If we zoom out and look at this cycle as a whole, we’re likely much closer to the end than the beginning. From the 2022 lows, BTC is now up over 600%. Even if we double from here and hit that lofty $200K target, that’s still only a 100% gain. And sure, that’s an incredible move—but it’s not where the real asymmetrical opportunities lie.

I know it feels like Bitcoin can’t go down again—but it will. And when it does, it’ll fall harder and longer than most people expect. That’s when you want to be a heavy buyer. Not when it has 40–60% upside left in the tank.

With that in mind, I’m still planning to buy a dip into the mid-to-low $90,000s if we get it. I’ll do so knowing that a wick down into the mid-$80,000s is perfectly possible—and I’m prepared to add there, too. I still believe we’ll hit both Target 1 and likely Target 2 for this cycle, which makes the $90,000–$80,000 range an acceptable buy zone from a risk/reward standpoint.

I’ve been selling into strength in the $95,000–$105,000 region on IBIT, prepping for a pullback. If I can reload below where I sold—great. If not, I still have my core position to ride up into the targets.

If you want detailed BTC breakdowns, make sure to check out the Real Life Trading Slack channels where I post near-daily Bitcoin update videos.

BTC Zoomed Out

BTC Zoomed In

Market Milestones: Chop-solidation-ways

Sideways consolidation has been the name of the game for the last two weeks. SPY has rejected the key 2015 analog target of $604 twice now and has closed below the 10-day EMA three times since last Friday. That’s notable considering SPY hadn’t even really tested the 10-day EMA—outside of a brief one-day dip on May 23rd—for two months, since the April 23rd gap up.

That said, fading volume, declining momentum, and sideways action don’t automatically mean the market is headed lower. But it usually means you’re closer to a top than a bottom.

Because the market has consolidated at the highs for a bit now, it still has the potential to break out into new all-time highs, trigger FOMO buys at the top, and then roll over—very much like we saw in our 2015 and 2018 analogs. In 2018, we did get that final new high before the sell-off. In 2015, we didn’t. Of course, analogs aren’t perfect playbooks—but they give us a solid framework for what could play out based on historical price action.

SPY broke below its first main support at $600 this week, leaving $595 and $590 as the next key levels to watch. If we start closing below—or especially gapping below—those levels, I’ll lean more confidently toward the start of a real pullback. Until then, I remain cautious-to-neutral.

Yeah, I know—that’s probably the most boring stance to take. But patience during sideways, choppy markets is a critical skill to master. It’s frustrating, it’s boring, but it’s also where a lot of people make unnecessary mistakes. Sit tight, plan, and let the market show its hand.

SPY

Over the last several weeks in this newsletter and in RLT, we’ve been keeping a close eye on small caps—because frankly, that’s where most of the trading action has been. Many of the large caps we follow have already made their big moves.

IWM, in particular, has a pretty clean inverse head and shoulders pattern forming. If it plays out, a move into $220- $225 is very possible—especially if SPY grinds to new highs.

From a risk-management perspective, the setup is actually pretty straightforward. There’s actually a bearish 10-day EMA trade present, and IWM has the 100-day SMA sitting just below. More aggressive traders might choose to manage risk on a close below Wednesday’s candle, the bearish 10-EMA trigger. More conservative traders could use the 100-day SMA (around $206) as their level. If we break below $202.50 and the pink trendline, the immediate bullish thesis is likely invalidated.

IWM

BTC hasn’t given us much to work with over the last month. It’s been consolidating in a tight triangle since hitting its all-time high on May 22nd—which makes sense, considering it ran nearly 50% in just 43 days.

If we zoom out and look at this cycle as a whole, we’re likely much closer to the end than the beginning. From the 2022 lows, BTC is now up over 600%. Even if we double from here and hit that lofty $200K target, that’s still only a 100% gain. And sure, that’s an incredible move—but it’s not where the real asymmetrical opportunities lie.

I know it feels like Bitcoin can’t go down again—but it will. And when it does, it’ll fall harder and longer than most people expect. That’s when you want to be a heavy buyer. Not when it has 40–60% upside left in the tank.

With that in mind, I’m still planning to buy a dip into the mid-to-low $90,000s if we get it. I’ll do so knowing that a wick down into the mid-$80,000s is perfectly possible—and I’m prepared to add there, too. I still believe we’ll hit both Target 1 and likely Target 2 for this cycle, which makes the $90,000–$80,000 range an acceptable buy zone from a risk/reward standpoint.

I’ve been selling into strength in the $95,000–$105,000 region on IBIT, prepping for a pullback. If I can reload below where I sold—great. If not, I still have my core position to ride up into the targets.

If you want detailed BTC breakdowns, make sure to check out the Real Life Trading Slack channels where I post near-daily Bitcoin update videos.

BTC Zoomed Out

BTC Zoomed In

ABOUT REAL LIFE TRADING

We are a stock trading education company. Our goal is to teach and empower people to create generational wealth to enrich their lives and communities.

ONLINE TRAINING LINKS