START TRADING WITH CONFIDENCE

JOIN A COMMUNITY COMMITTED TO YOUR SUCCESS

Are you new to trading and ready to make your mark? Or do you have experience but are struggling to become a consistently profitable trader?

Imagine having a community of like-minded traders and experts at your side, helping you navigate every step of the journey!

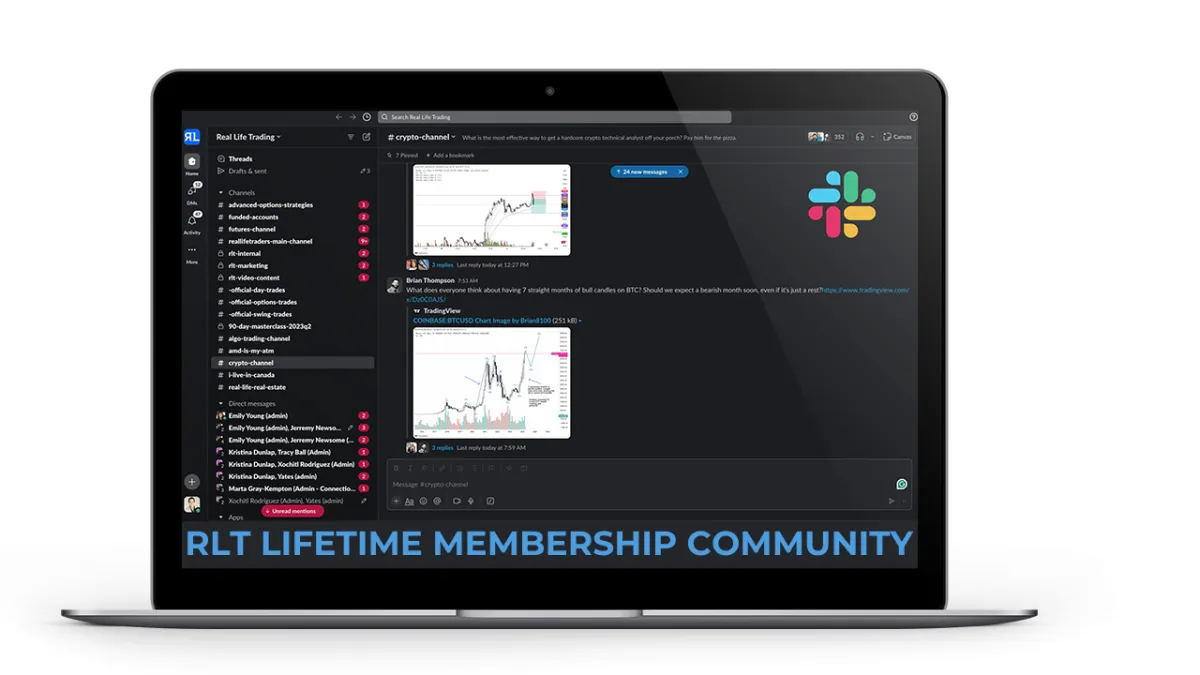

Join us and gain lifetime access to our exclusive Slack community—where you’ll find real-time support, valuable insights, and camaraderie with fellow traders. With FREE monthly courses and weekly live education sessions, we’re here to guide you every step of the way. Whether you're just starting out or looking to enhance your skills, you’ll have the tools and community you need to trade with confidence.

Start your journey today with a community dedicated to your success with a one-time $25 investment!

CREATE CASH FLOW AND KEEP IT

RETIRE EARLY AND LIVE THE LIFE YOU WANT

We teach people how to make money from the stock and crypto markets and KEEP IT by following simple and proven strategies that have generated $10,000,000+ for our customers and their families.

Tired of working for someone else? Dream of trading full-time?

Now’s your chance to make it happen!

Become a Full-Time Trader in 2025 with Tony Pawlak's

Elite 10-Month Premier Coaching Program !

Registration Only Opened Once a Year!

This isn’t just another program —

it’s a proven pathway to success. Over the years, Tony has helped countless students quit their jobs and transition into full-time trading. Through personalized coaching and hands-on training, he will guide you step by step to ensure you not only learn, but master the essential skills needed to consistently win in the markets.

AS FEATURED IN

Want to Trade LIVE with other TRADERS?

Get signed up for our immersive, high-energy, active stock trading rooms.

You'll get detailed insights on entries, exits, targets, and explanations.

We answer viewer questions in real time.

Get All Access to All Live Trading Rooms + Slack + RLT Newsletter

Just $275/Month - Best Value

Real-time trades you can follow

Exclusive Weekly Mentorships

Expert 1:1 trading support on demand

Access to a private slack group

Access to an incredible community of RLT traders to support you on your journey

Get access to live day trade & swing trading rooms

Live practice sessions/drills and strategies + get real-time feedback

Live market recaps and analysis

Weekly Q&A session to review your trades and answer your trading questions.

RLT Newsletter with trade alerts, stock picks and market analysis

Live Day Trading Room

Just $179/Month

Real-time trades you can follow

Expert 1:1 trading support on demand

Access to an incredible community of RLT traders

Get access to our live day trading room

Live practice sessions/drills and strategies + get real-time feedback

Live market recaps and analysis

Live SWING Trading Room

Just $149/Month

Real-time trades you can follow

Expert 1:1 trading support on demand

Access to an incredible community of RLT traders

Get access to our live swing trading room

Live practice sessions/drills and strategies + get real-time feedback

Live market recaps and analysis

RLT Education Programs

Mentorships

Unlock Your Trading Potential with

Funded Trading

Do you have the skills to trade, but lack the capital to make your mark in the markets?

Funded trading could be the solution you've been waiting for. With funded trading, you can trade with the backing of a funding company who will provide you with the trading capital, allowing you to focus on your strategy without the burden of risking your own capital.

Apex Trader Funding was established in

2021 with the goal of revolutionizing the trader payout model. It was founded out of dissatisfaction with existing funding companies and a desire to adopt a more customer-centric approach. As a premier trader funding company, Apex Trader Funding (ATF) outperforms other futures funding evaluation firms in terms of payouts. With a vast global community spanning over 150 countries and tens of thousands of members, Apex Trader Funding, headquartered in Austin, Texas, specializes in funding evaluations for futures markets.

Receive 100% of the first $25,000 per Account and 90% Beyond That

Two Payouts per Month

Trade Full-Sized Contracts in Evaluations or Funded Accounts

No Scaling or Failing by Going Over Contract Size

No Daily Drawdowns

Trade on Holidays

Trade Your Normal Day-to-Day Strategy or System During The News

No Total Cap on Maximum Payout

One-Step Evaluation Process

Real-Time Data Included

Simple Risk Management Rules

Trade With Multiple Accounts up to 20 max

If you’re a trader with the knowledge and skill but are held back by limited capital, Apex Trader Funding offers you the chance to access the capital you need to trade confidently.

Join the revolution in trading today with Apex Trader Funding, where your potential is funded, and your success is our priority.

FREE TRADING RESOURCES

Take FREE online courses to learn how to earn extra income while keeping your day job, Paying off debt, investing in your future, and Retiring Early

BEGINNER GUIDE TO DAY TRADING COURSE

FREE

BEGINNER GUIDE TO SWING TRADING COURSE

FREE

BEGINNER GUIDE TO INVESTING COURSE

FREE

GET TRADE ALERTS

Just $59/Month

Are you unable to find the time to build your own trading plans, do your own scans, or set up your own alerts? If so, our systems have you covered. Seize this opportunity to establish yourself as a consistent and disciplined trader and grow your trading account. Begin your journey today by subscribing to the RLT Newsletter.

MONEY MAKING BLOGS

Market Milestones: Made In America

One thing you definitely can’t say about this market is that it’s boring. If you’ve traded through—and survived or even thrived—during the past week of price action, give yourself a well-earned pat on the back. It’s been extreme. As of now, Monday’s gap down appears to have formed a capitulation low, and with a little help from Donald Trump, we’ve retested nearly the entire “Liberation” drop from last week.

Don’t expect the volatility to vanish overnight. Many of the market’s underlying concerns are still present, but the more immediate and menacing issue—tariffs—has been temporarily pushed aside. With all tariffs reduced to 10%, except for China, which was hit with a massive 145% tariff, the stock market found some room to breathe. The same can’t be said for the bond market.

SPY

The bond market essentially forced the Trump administration to pivot, nearly imploding on Monday as the 20- and 30-year yields spiked around 5%. Credit where it’s due—Trump and his team took the hint and adjusted course. It had to be the administration that moved here, because the Fed’s hands are tied. They’ve been the backstop since 2008, but not this time. Ever since the Fed cut rates on 9/16/2024, long-dated bonds have been in a freefall. The Fed can’t risk stepping in to save equities right now because the bond market is much larger—and far more critical to the government.

This year, the government needs to refinance somewhere between $8 and $10 trillion in debt. The reports vary, but what’s a few trillion among friends? This refinancing will rely heavily on long-dated bonds, and with the servicing costs already exceeding the annual defense budget, refinancing at these elevated rates would put even more pressure on the nation’s debt load. Even though inflation came down to 2.4% for March, the bond market doesn’t care. Logic would suggest that with a possible global recession on the horizon, investors would flock to bonds—but that hasn’t been the case. Apparently, the bond market is still more concerned about inflation, which effectively takes QE off the table for now.

TLT

Looking at some of our go-to equity charts, the verdict is mixed on whether the low is in. IWM and RSP still look vulnerable and could easily roll over for another leg lower. On the other hand, SMH and QQQ are showing more relative strength, while SPY sits somewhere in the middle. Since SPY and QQQ printed $50 candles on Thursday, we could easily chop inside those ranges for a while. Realistically, if volatility were back to normal, we might be stuck inside that candle for another two months before anything meaningful happens. But volatility is still extremely elevated, and the market remains on edge.

IWM

On Thursday, QQQ technically hit a limit-down level, dropping 7% and triggering a 2 minute timer. Since it bounced at that level for two minutes, the breaker was reset to 13% lower—or at least, that’s my understanding of how it worked and why the market did not get halted on Thursday.

As I mentioned in Wednesday’s newsletter, these kinds of massive candles don’t typically show up in bull markets. They’re more common in bear markets, especially during peak fear. Wednesday’s “lightsaber” candle likely marked the low for now, but I wouldn’t be surprised to see that low taken out before all is said and done.

Thursday’s candle on QQQ and SPY retraced just past the 61.8% fib level and closed well above the 50% retrace and the 100-week SMA. That’s a solid sign the bulls are trying to hold this market up and could help us grind higher toward some upper targets where we can hedge positions and lock in gains in case the market rolls once again.

QQQ

To sum up my current thesis: I expect the market to move higher over the next couple of weeks, with a good chance we chop inside Wednesday’s candle longer than most would like. If we can break above that candle, the long-term daily moving averages will likely serve as resistance—and as targets for my bullish positions. That’s the level where I’ll start to get more cautious and watch for a potential larger rollover. Until then, I’ll be looking to buy the dips and continue selling options into this elevated volatility.

This is an ideal time to be selling puts on companies you’d love to own at prices you’d be happy to pay. Over the last 36 trading days, I’ve posted six put sales that brought in $722.00 in premium—enough to pay for over a full year of the RLT Newsletter. On Thursday, I posted four more put sales, for another $458 in premium set to expire next week. If you’re not already part of our thriving RLT Newsletter community, now’s the ideal time to join.

Market Milestones: Made In America

One thing you definitely can’t say about this market is that it’s boring. If you’ve traded through—and survived or even thrived—during the past week of price action, give yourself a well-earned pat on the back. It’s been extreme. As of now, Monday’s gap down appears to have formed a capitulation low, and with a little help from Donald Trump, we’ve retested nearly the entire “Liberation” drop from last week.

Don’t expect the volatility to vanish overnight. Many of the market’s underlying concerns are still present, but the more immediate and menacing issue—tariffs—has been temporarily pushed aside. With all tariffs reduced to 10%, except for China, which was hit with a massive 145% tariff, the stock market found some room to breathe. The same can’t be said for the bond market.

SPY

The bond market essentially forced the Trump administration to pivot, nearly imploding on Monday as the 20- and 30-year yields spiked around 5%. Credit where it’s due—Trump and his team took the hint and adjusted course. It had to be the administration that moved here, because the Fed’s hands are tied. They’ve been the backstop since 2008, but not this time. Ever since the Fed cut rates on 9/16/2024, long-dated bonds have been in a freefall. The Fed can’t risk stepping in to save equities right now because the bond market is much larger—and far more critical to the government.

This year, the government needs to refinance somewhere between $8 and $10 trillion in debt. The reports vary, but what’s a few trillion among friends? This refinancing will rely heavily on long-dated bonds, and with the servicing costs already exceeding the annual defense budget, refinancing at these elevated rates would put even more pressure on the nation’s debt load. Even though inflation came down to 2.4% for March, the bond market doesn’t care. Logic would suggest that with a possible global recession on the horizon, investors would flock to bonds—but that hasn’t been the case. Apparently, the bond market is still more concerned about inflation, which effectively takes QE off the table for now.

TLT

Looking at some of our go-to equity charts, the verdict is mixed on whether the low is in. IWM and RSP still look vulnerable and could easily roll over for another leg lower. On the other hand, SMH and QQQ are showing more relative strength, while SPY sits somewhere in the middle. Since SPY and QQQ printed $50 candles on Thursday, we could easily chop inside those ranges for a while. Realistically, if volatility were back to normal, we might be stuck inside that candle for another two months before anything meaningful happens. But volatility is still extremely elevated, and the market remains on edge.

IWM

On Thursday, QQQ technically hit a limit-down level, dropping 7% and triggering a 2 minute timer. Since it bounced at that level for two minutes, the breaker was reset to 13% lower—or at least, that’s my understanding of how it worked and why the market did not get halted on Thursday.

As I mentioned in Wednesday’s newsletter, these kinds of massive candles don’t typically show up in bull markets. They’re more common in bear markets, especially during peak fear. Wednesday’s “lightsaber” candle likely marked the low for now, but I wouldn’t be surprised to see that low taken out before all is said and done.

Thursday’s candle on QQQ and SPY retraced just past the 61.8% fib level and closed well above the 50% retrace and the 100-week SMA. That’s a solid sign the bulls are trying to hold this market up and could help us grind higher toward some upper targets where we can hedge positions and lock in gains in case the market rolls once again.

QQQ

To sum up my current thesis: I expect the market to move higher over the next couple of weeks, with a good chance we chop inside Wednesday’s candle longer than most would like. If we can break above that candle, the long-term daily moving averages will likely serve as resistance—and as targets for my bullish positions. That’s the level where I’ll start to get more cautious and watch for a potential larger rollover. Until then, I’ll be looking to buy the dips and continue selling options into this elevated volatility.

This is an ideal time to be selling puts on companies you’d love to own at prices you’d be happy to pay. Over the last 36 trading days, I’ve posted six put sales that brought in $722.00 in premium—enough to pay for over a full year of the RLT Newsletter. On Thursday, I posted four more put sales, for another $458 in premium set to expire next week. If you’re not already part of our thriving RLT Newsletter community, now’s the ideal time to join.

ABOUT REAL LIFE TRADING

We are a stock trading education company. Our goal is to teach and empower people to create generational wealth to enrich their lives and communities.

ONLINE TRAINING LINKS