START TRADING WITH CONFIDENCE

JOIN A COMMUNITY COMMITTED TO YOUR SUCCESS

Are you new to trading and ready to make your mark? Or do you have experience but are struggling to become a consistently profitable trader?

Imagine having a community of like-minded traders and experts at your side, helping you navigate every step of the journey!

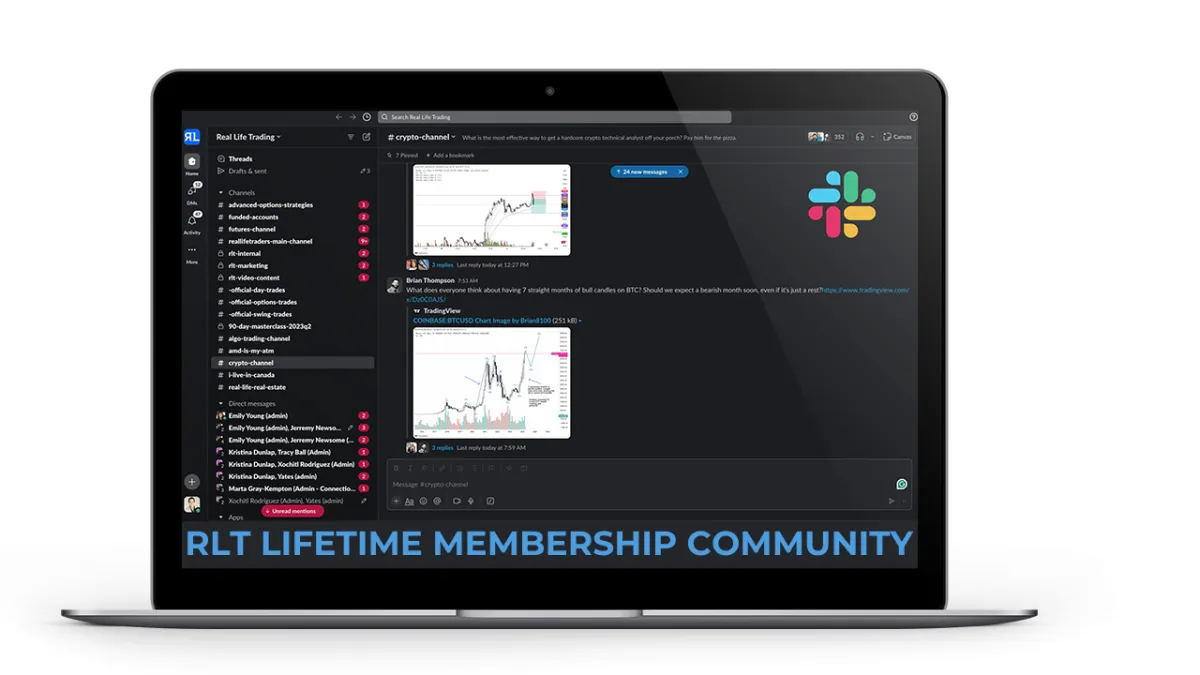

Join us and gain lifetime access to our exclusive Slack community—where you’ll find real-time support, valuable insights, and camaraderie with fellow traders. With FREE monthly courses and weekly live education sessions, we’re here to guide you every step of the way. Whether you're just starting out or looking to enhance your skills, you’ll have the tools and community you need to trade with confidence.

Start your journey today with a community dedicated to your success with a one-time $25 investment!

CREATE CASH FLOW AND KEEP IT

RETIRE EARLY AND LIVE THE LIFE YOU WANT

We teach people how to make money from the stock and crypto markets and KEEP IT by following simple and proven strategies that have generated $10,000,000+ for our customers and their families.

Tired of working for someone else? Dream of trading full-time?

Now’s your chance to make it happen!

Become a Full-Time Trader in 2025 with Tony Pawlak's

Elite 10-Month Premier Coaching Program !

Registration Only Opened Once a Year!

This isn’t just another program —

it’s a proven pathway to success. Over the years, Tony has helped countless students quit their jobs and transition into full-time trading. Through personalized coaching and hands-on training, he will guide you step by step to ensure you not only learn, but master the essential skills needed to consistently win in the markets.

AS FEATURED IN

Want to Trade LIVE with other TRADERS?

Get signed up for our immersive, high-energy, active stock trading rooms.

You'll get detailed insights on entries, exits, targets, and explanations.

We answer viewer questions in real time.

Get All Access to All Live Trading Rooms + Slack + RLT Newsletter

Just $275/Month - Best Value

Real-time trades you can follow

Exclusive Weekly Mentorships

Expert 1:1 trading support on demand

Access to a private slack group

Access to an incredible community of RLT traders to support you on your journey

Get access to live day trade & swing trading rooms

Live practice sessions/drills and strategies + get real-time feedback

Live market recaps and analysis

Weekly Q&A session to review your trades and answer your trading questions.

RLT Newsletter with trade alerts, stock picks and market analysis

Live Day Trading Room

Just $179/Month

Real-time trades you can follow

Expert 1:1 trading support on demand

Access to an incredible community of RLT traders

Get access to our live day trading room

Live practice sessions/drills and strategies + get real-time feedback

Live market recaps and analysis

Live SWING Trading Room

Just $149/Month

Real-time trades you can follow

Expert 1:1 trading support on demand

Access to an incredible community of RLT traders

Get access to our live swing trading room

Live practice sessions/drills and strategies + get real-time feedback

Live market recaps and analysis

RLT Education Programs

Mentorships

Unlock Your Trading Potential with

Funded Trading

Do you have the skills to trade, but lack the capital to make your mark in the markets?

Funded trading could be the solution you've been waiting for. With funded trading, you can trade with the backing of a funding company who will provide you with the trading capital, allowing you to focus on your strategy without the burden of risking your own capital.

Apex Trader Funding was established in

2021 with the goal of revolutionizing the trader payout model. It was founded out of dissatisfaction with existing funding companies and a desire to adopt a more customer-centric approach. As a premier trader funding company, Apex Trader Funding (ATF) outperforms other futures funding evaluation firms in terms of payouts. With a vast global community spanning over 150 countries and tens of thousands of members, Apex Trader Funding, headquartered in Austin, Texas, specializes in funding evaluations for futures markets.

Receive 100% of the first $25,000 per Account and 90% Beyond That

Two Payouts per Month

Trade Full-Sized Contracts in Evaluations or Funded Accounts

No Scaling or Failing by Going Over Contract Size

No Daily Drawdowns

Trade on Holidays

Trade Your Normal Day-to-Day Strategy or System During The News

No Total Cap on Maximum Payout

One-Step Evaluation Process

Real-Time Data Included

Simple Risk Management Rules

Trade With Multiple Accounts up to 20 max

If you’re a trader with the knowledge and skill but are held back by limited capital, Apex Trader Funding offers you the chance to access the capital you need to trade confidently.

Join the revolution in trading today with Apex Trader Funding, where your potential is funded, and your success is our priority.

FREE TRADING RESOURCES

Take FREE online courses to learn how to earn extra income while keeping your day job, Paying off debt, investing in your future, and Retiring Early

BEGINNER GUIDE TO DAY TRADING COURSE

FREE

BEGINNER GUIDE TO SWING TRADING COURSE

FREE

BEGINNER GUIDE TO INVESTING COURSE

FREE

GET TRADE ALERTS

Just $59/Month

Are you unable to find the time to build your own trading plans, do your own scans, or set up your own alerts? If so, our systems have you covered. Seize this opportunity to establish yourself as a consistent and disciplined trader and grow your trading account. Begin your journey today by subscribing to the RLT Newsletter.

MONEY MAKING BLOGS

Market Milestones: Shaved Bottom

All major markets broke down in a big way on Thursday. SPY dropped 4.93%, QQQ fell 5.35%, IWM slid 6.42%, and SMH led the plunge, closing down 8.65%. The Magnificent 7 took a beating as well—AAPL, AMZN, and META all dropped roughly 9%. There was blood in the streets as the market scrambled to price in the impact of Liberation Day and Trump’s reciprocal tariffs. While it’ll take time to truly understand the effect of these tariffs, the market's initial reaction made one thing clear: if they’re implemented as laid out in the Rose Garden, the outlook isn’t bullish. The odds of a recession are skyrocketing—and if nothing changes with the tariffs, 2025 is going to get a lot bumpier.

Markets have been in pure euphoria for the last couple years, and it’s been wild to watch how fast sentiment has shifted. On February 19th, most market participants couldn’t even imagine stocks going down. FOMO was everywhere as record amounts of capital chased the Magnificent 7, trying to squeeze the last drop out of the AI trade. Now, sentiment is in the gutter. People are panic-selling everything, convinced stocks will never go up again. Traders who would’ve given their left foot to buy the Mag 7 at a 30% discount just weeks ago now think AI is bubble and are allergic to the buy button. This is how it always works—sentiment is everything.

The Liberation gap was absolutely devastating for bulls. It shot the probabilities of a bear market way up and made everyone with money in the markets sit up and take notice. Volume exploded—higher than we’ve seen in over a year—which could be a sign we’re starting a third wave lower. That wave would send SPY down to the $513–$480 support/buy zone we’ve been watching.

But if you're looking for a little bullish hopium, I might actually have some. Hear me out—markets tend to inflict max pain. Right now, I can’t think of a more painful move than a bullish close above Wednesday’s candle. No one would be right in that scenario. SPX held support around $5400, while SPY actually broke below it, closing right at the day’s lows with a textbook shaved-bottom candle. If we get any big news—tariff delays or moderation—you could see a vicious short-covering rally that rips through Wednesday’s highs. I’d still treat that move as a chance to sell, hedge, or reload shorts, because the overall structure is broken—especially in QQQ and tech—but it’s a move worth watching for. SPX holding its support, even barely, keeps that bounce setup, and maybe a few bulls dreams alive.

Now for the more bearish and, realistically, more probable scenario. Every path I’m tracking leads to lower lows—the only difference is the timeline. I mentioned the text book shaved bottom candle above, so let’s dive a little deeper into that. Typically, that sets up a gap down the next morning—a retest gap—as traders who sold all the way into and after the close cover their shorts. However, if the fear is strong enough there is no reason to cover and that gap can turn into a continuation move, just like it did after the shaved-bottom candle on SPY back on 6/9/2022. For a good example of a gap down that led to a bit of a bullish bounce check out 1/24/2022. I’ve overlaid both patterns on the current SPY chart to help you visualize what could be coming next for the markets.

You’ll notice both historical overlays show solid bounces before the next big drop. That’s just how markets work. They don’t fall in a straight line. Even in bear markets, you’ll get sharp countertrend rallies—great opportunities to manage risk, hedge recent buys, and lock in profits. That’s why I’m still planning to buy once we start hitting key green support zones shown on the SPY chart. There is money to be made in both directions right now; it’s all about patience, execution, and a little luck that Trump doesn’t announce something that immediately negates your edge.

P.S. How about that Bitcoin relative strength!

Market Milestones: Shaved Bottom

All major markets broke down in a big way on Thursday. SPY dropped 4.93%, QQQ fell 5.35%, IWM slid 6.42%, and SMH led the plunge, closing down 8.65%. The Magnificent 7 took a beating as well—AAPL, AMZN, and META all dropped roughly 9%. There was blood in the streets as the market scrambled to price in the impact of Liberation Day and Trump’s reciprocal tariffs. While it’ll take time to truly understand the effect of these tariffs, the market's initial reaction made one thing clear: if they’re implemented as laid out in the Rose Garden, the outlook isn’t bullish. The odds of a recession are skyrocketing—and if nothing changes with the tariffs, 2025 is going to get a lot bumpier.

Markets have been in pure euphoria for the last couple years, and it’s been wild to watch how fast sentiment has shifted. On February 19th, most market participants couldn’t even imagine stocks going down. FOMO was everywhere as record amounts of capital chased the Magnificent 7, trying to squeeze the last drop out of the AI trade. Now, sentiment is in the gutter. People are panic-selling everything, convinced stocks will never go up again. Traders who would’ve given their left foot to buy the Mag 7 at a 30% discount just weeks ago now think AI is bubble and are allergic to the buy button. This is how it always works—sentiment is everything.

The Liberation gap was absolutely devastating for bulls. It shot the probabilities of a bear market way up and made everyone with money in the markets sit up and take notice. Volume exploded—higher than we’ve seen in over a year—which could be a sign we’re starting a third wave lower. That wave would send SPY down to the $513–$480 support/buy zone we’ve been watching.

But if you're looking for a little bullish hopium, I might actually have some. Hear me out—markets tend to inflict max pain. Right now, I can’t think of a more painful move than a bullish close above Wednesday’s candle. No one would be right in that scenario. SPX held support around $5400, while SPY actually broke below it, closing right at the day’s lows with a textbook shaved-bottom candle. If we get any big news—tariff delays or moderation—you could see a vicious short-covering rally that rips through Wednesday’s highs. I’d still treat that move as a chance to sell, hedge, or reload shorts, because the overall structure is broken—especially in QQQ and tech—but it’s a move worth watching for. SPX holding its support, even barely, keeps that bounce setup, and maybe a few bulls dreams alive.

Now for the more bearish and, realistically, more probable scenario. Every path I’m tracking leads to lower lows—the only difference is the timeline. I mentioned the text book shaved bottom candle above, so let’s dive a little deeper into that. Typically, that sets up a gap down the next morning—a retest gap—as traders who sold all the way into and after the close cover their shorts. However, if the fear is strong enough there is no reason to cover and that gap can turn into a continuation move, just like it did after the shaved-bottom candle on SPY back on 6/9/2022. For a good example of a gap down that led to a bit of a bullish bounce check out 1/24/2022. I’ve overlaid both patterns on the current SPY chart to help you visualize what could be coming next for the markets.

You’ll notice both historical overlays show solid bounces before the next big drop. That’s just how markets work. They don’t fall in a straight line. Even in bear markets, you’ll get sharp countertrend rallies—great opportunities to manage risk, hedge recent buys, and lock in profits. That’s why I’m still planning to buy once we start hitting key green support zones shown on the SPY chart. There is money to be made in both directions right now; it’s all about patience, execution, and a little luck that Trump doesn’t announce something that immediately negates your edge.

P.S. How about that Bitcoin relative strength!

ABOUT REAL LIFE TRADING

We are a stock trading education company. Our goal is to teach and empower people to create generational wealth to enrich their lives and communities.

ONLINE TRAINING LINKS