Take Control of Your Financial Future

And Build the Life You Have Always Dreamed Of

Welcome to the RLT Newsletter

Helping Everyday Traders Beat the Market with Practical, Realistic Strategies

At the RLT Newsletter, our mission is simple: to educate and empower ordinary people to take control of their financial futures and manage their investments with confidence. We strive to help regular individuals like you invest and protect their hard-earned money to build a better life for themselves and their families.

Whether you're a beginner or a seasoned investor, our rules-based systems and clear analysis are designed to help you grow your wealth effectively—while giving you more time to focus on what truly matters in your life.

Struggling with Time, Knowledge, or Consistency?

Do you view investing as something that takes too much time, costs too much money, or feels too overwhelming to tackle on your own?

Maybe you can’t find the time to create trading plans, run scans, or set up alerts.

Are consistency and discipline your biggest hurdles, making it hard to stick to and follow a plan?

If this resonates with you,

The RLT Newsletter is here to help.

Our expert market analysis and proven, rules-based trading systems empower you to approach the stock market with confidence, discipline, and clarity. It’s time to overcome the challenges holding you back, face the market head-on, and come out victorious. The stock market is the best wealth creation device known to man and it’s time for you to start actively participating in it. Let us help you thrive!

Join the RLT Newsletter today to take back your time and secure your financial future.

Your Success, Our Mission: Empowering You to Win in the Market

Let Us Help You Succeed

Stay Informed: Receive 4 emails per week with market news and key price updates.

Follow Proven Systems:

Gain access to 4 live trading portfolios, updated in real-time.

Save Time:

Make adjustments to your portfolio in just minutes each day.

Gain Confidence: Learn from clear, concise charts and expert analysis tailored for all skill levels.

Master the Market:

Dive deep into technical analysis with insights on gap dynamics, macro trends, Fibonacci retracements, and Elliott Wave theory.

At Real Life Trading, we understand the challenges you’re facing, whether you’re just starting out or trying to break through to consistent profitability.

WHAT'S INCLUDED WITH THE RLT NEWSLETTER:

4 live trading portfolios:

Long-term Swing Trading

Long-term Investing

Momentum Trading

Short-term trading

4 weekly newsletters with trade alerts, stock picks, and market insights.

A weekly video featuring market rundowns and top stocks to watch.

On-demand support from an expert team of investors.

Portal access to track all actively managed portfolios.

Slack access to engage daily with our market analysts and the community.

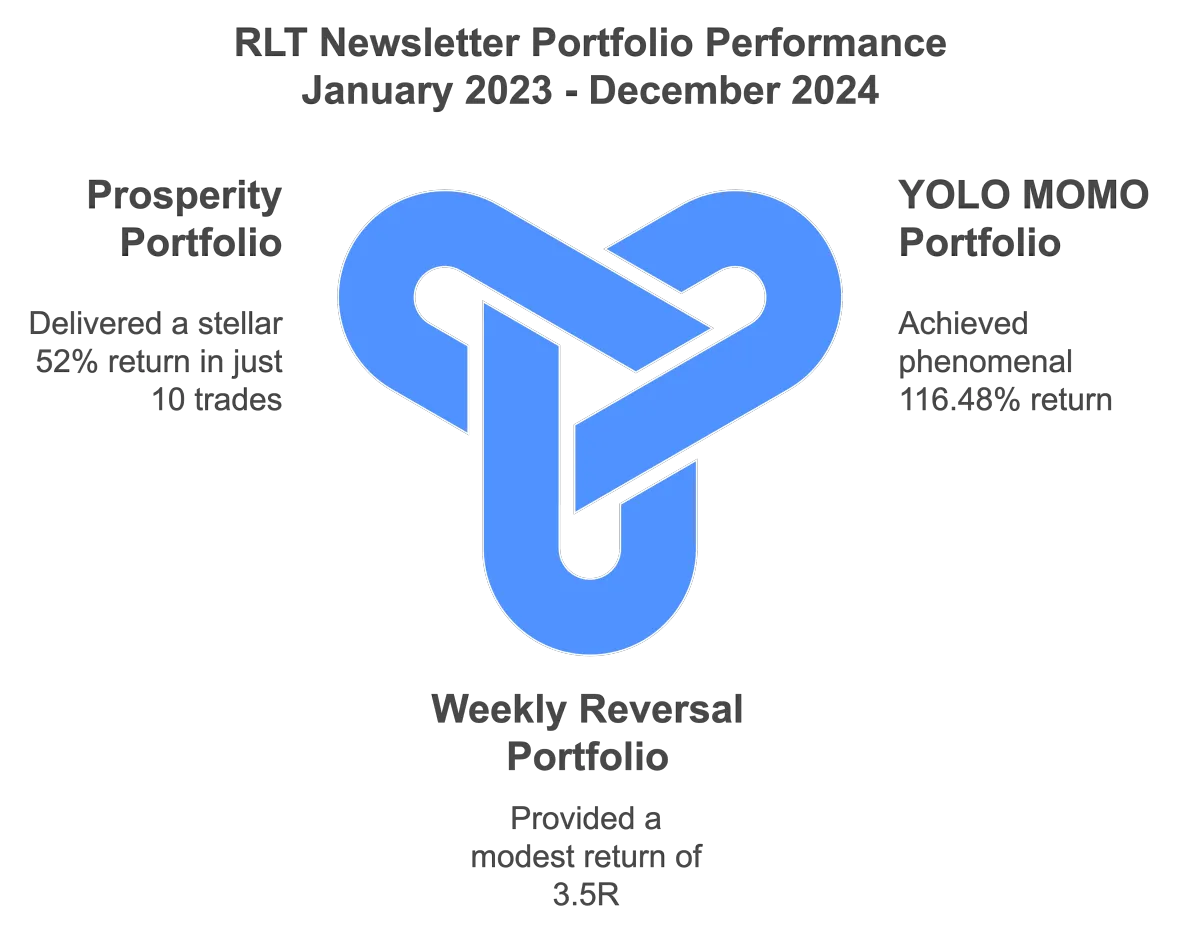

Our Momentum Trading plan gets you exposure to the strongest stocks on the planet and helps you ride them higher for serious profits.

Our Prosperity Portfolio helps traders beat the market with just a few trades each year while managing downside risk. This slow and steady system is perfect for retirement accounts, long term trading accounts or anyone who wants amazing returns with very little time commitment.

Choose Excellence, Choose Results: Here’s Why We’re Your Best Bet

Our Promise to You

The Real Life Trading Newsletter stands apart from other financial publications by embracing a rules-based approach to the market and offering a genuine and realistic approach to the realities of trading. We recognize that trading entails both wins and losses, which is why we provide our members with straightforward, realistic expectations. Our commitment to transparency and authenticity combined with our sincere desire to empower our subscribers to reach their financial goals is what sets us apart. Join us as we take our trading skills and our trading accounts to the next level.

Don't Just Take Our Word For It...

Here's What Others Have To Say

Emails That Grow Your Wealth: How the RLT Newsletter Boosts Your Retirement Account and More

"Do you like "Mailbox Money"? What about great trade setups and ideas delivered straight to your email a few times a week? If your answer is yes, then you need to sign up for the RLT Newsletter. The YOLO MOMO and Prosperity Portfolio setups have been crushing the returns this year while managing risk. And every Tuesday, I get a video with some amazing chart analysis and trade ideas. My retirement account just keeps growing and it is all thanks to the RLT Newsletter!”

-Jason K.

From Confidence to Cash Flow: How the RLT Newsletter Transformed My Trading

"The RLT Newsletter is a great combination of technical analysis, trade ideas, and portfolio management. Both Yates and Jerremy are master technicians. I use the RLT Newsletter for short-term swing trade ideas and to practice my technical analysis. The Newsletter has increased my monthly cash flow, and it has given me the confidence to make my own trades based on the technical analysis provided. This Newsletter is an amazing value for the price. Highly recommended!”

-Chris W.

A Lifesaver for Busy Traders: How the RLT Newsletter Makes Every Hour Count

"I just can't stress enough how much I love your newsletters and how grateful I am for them. For a full time worker like myself that only has 1 hour a day to work on trading, it's a life saver! Thank you for all your time and effort putting them together!”

-Christopher W.

Finding the Perfect Fit: How the RLT Newsletter and Community Inspire Growth and Impact

"The RLT newsletter has been the right fit for me in the RLT community! I am hoping to continue to find ways to evolve, get more involved and use this education to change lives. Love your mission and the community of helpful people."

-Brian H.

Take the guesswork out of trading.

Gain the tools, insights, and support you need to succeed in the markets.

Just $59/Month

Frequently Asked Questions

How many emails will I receive each week?

You’ll receive 4 regular weekly emails on Monday, Tuesday, Thursday, and Friday. Additionally, you’ll receive occasional emails with portfolio updates as needed.

Can I cancel my monthly subscription anytime?

Yes! If you’re on the $59 monthly plan, you can cancel anytime, and your subscription will continue through the end of your current billing period.

Are the RLT Newsletter portfolios traded with live money?

No, all four RLT Newsletter portfolios are tracked in a simulated, paper trading account for educational and entertainment purposes only. Our goal is to teach traders how to manage risk and their own portfolios effectively. We are stock market educators, not financial advisors. If you need personalized financial advice, we strongly encourage you to consult a qualified financial professional.

Do the RLT Newsletter analysts take all the trades in the portfolios?

No, the analysts do not personally take every trade in the portfolios.

Are the stocks reviewed in the Tuesday Top Trade Video part of the 4 portfolios?

Not necessarily. While active or prospective trades for the portfolios may occasionally be discussed, the majority of the video focuses on general market reviews and stock charts that appear interesting from a technical analysis perspective.

What is the Prosperity Portfolio?

The Prosperity Portfolio is a long-term swing trading system that focuses exclusively on the QQQ. This long-only strategy aims to outperform the market by staying out during bearish periods and remaining invested during bullish trends. Unlike traditional buy-and-hold strategies, it actively manages downside risk, making it ideal for long-term investors seeking steady growth with reduced volatility. With only a handful of trades each year, it’s a time-efficient resource for those who want to grow their portfolio without the need for frequent trading.

What is the YOLO MOMO Portfolio?

YOLO, short for “you only live once,” paired with MOMO, short for “momentum,” defines the essence of the YOLO MOMO Portfolio. This momentum-driven, aggressive swing trading strategy focuses on capturing significant moves in the market’s strongest-performing tech stocks. With an emphasis on relative strength and excellent risk-reward setups, this system offers the potential for outsized returns. It comes with high volatility and large portfolio swings, making it an ideal resource for traders seeking aggressive growth and who are comfortable taking on higher levels of risk.

What is the RL Swing Stalker Portfolio?

The RL Swing Stalker Portfolio is a short-term swing trading system that leverages advanced market scans to uncover opportunities. Using the R system for precise risk management, this strategy takes both bullish and bearish trades to maximize profit potential. It’s an ideal resource for active traders looking for a system with well-defined risk parameters and frequent trading opportunities.

What is the HODL Hero’s Portfolio?

The HODL Hero’s Portfolio is a long-term investing strategy aimed at achieving substantial returns by holding high-quality stocks for extended periods. Risk is managed using advanced options strategies. This long-term portfolio does not use the R system for risk management, meaning it can experience larger drawdowns. This portfolio is a resource for long term investors focused on long-term growth and who are willing to embrace more volatility.

DISCLAIMER - PLEASE READ BEFORE MAKING ANY RLT NEWSLETTER TRADES

Disclaimer: Each portfolio in the RLT Newsletter is a hypothetical paper trading account. Real Life Trading and its analysts use these portfolios as an educational tool. It’s important to note that Real Life Trading nor its analysts are actively managing live, real-money portfolios. The analysts and moderators may or may not trade any of the given equities.

CFTC Rule 4.41: These results are based on hypothetical or simulated performance results with inherent limitations. Unlike actual performance records, these results do not represent real trading. Because these trades haven't been executed, the results may have under- or over-compensated for the impact of certain market factors, such as the lack of liquidity. Hypothetical or simulated trading programs are designed with the benefit of hindsight, and no representation is being made that any account will or is likely to achieve profits or losses similar to those shown.

Trading Risks: Real Life Trading LLC (“Company”) is not an investment advisory service, nor a registered investment advisor or broker-dealer and does not purport to tell or suggest which securities customers should buy or sell for themselves. The independent contractors, employees or affiliates of Company may hold positions in the stocks, options, currencies or industries discussed here. You understand and acknowledge that there is a very high degree of risk involved in trading securities, options and/or currencies. The Company assumes no responsibility or liability for your trading and investment results. It should not be assumed that the methods, techniques, or indicators presented will be profitable or that they will not result in losses. Past results of any individual trader or trading system presented by the Company are not indicative of future returns by that trader or system, and are not indicative of future returns which will be realized by you. In addition, the indicators, strategies, and all other features of Company’s products (collectively, the “Information”) are provided for informational and educational purposes only and should not be construed as investment advice.

MONEY MAKING BLOGS

Market Milestones: AI Revolution

The Coming AI Revolution

Between now and the early 2030s, the world will undergo a transformation so rapid and far-reaching that our current understanding of business, work, economies, and power structures will be almost unrecognizable. Artificial intelligence isn’t just another wave of innovation—it’s a seismic shift in how humanity functions day to day.

We’re not just talking about task automation anymore. We’re entering a moment where both labor and knowledge—two cornerstones of today’s economy—are on the verge of becoming abundant. The only true constraint? Energy.

This level of disruption makes long-term predictions nearly impossible. The scale is too vast. But what we can do is prepare—and that starts by positioning ourselves wisely before the traditional human workforce is permanently changed.

Why This Decade Matters

The next five to ten years may be the final stretch where the economic system still resembles what we know. This is our window. Now is the time to earn aggressively, invest strategically, and accumulate assets that can thrive in a post-AI world.

I believe that a portfolio focused on stocks and Bitcoin—with concentrated exposure to AI leaders—can provide a path to financial independence before large swaths of the labor force are disrupted.

With the right positions in key names (which we’ll get to shortly), it’s possible to generate consistent monthly income—potentially enough to replace a typical W-2 salary. But it’s not just about buying assets at great levels, before things get totally bonkers. It’s equally important to develop the skills of trading and investing for income. Mastering risk management, hedging, and premium selling, while patiently buying low at key support zones, is what can truly pave the way to financial freedom.

At Real Life Trading, we teach and apply technical analysis alongside income-generating strategies like covered calls, cash-secured puts, collars, and more. These tools allow you to consistently extract income from your portfolio—even in a future where jobs could be scarce.

This Shift Is Bigger Than the Industrial Revolution

To grasp the stakes, think back to the Industrial Revolution. Yes, it replaced manual labor with machines—but it also created new jobs to absorb displaced workers. The AI revolution cuts deeper. We may see entire job categories vanish, with no clear replacements. This time, the disruption doesn’t just change what we do—it challenges what our role is in the economic machine.

Some sectors will disappear. Others will consolidate under companies that master AI. In that chaotic reshuffling, one thing is clear: owning shares in the companies driving the AI future is one of the smartest moves you can make.

Abundance Breaks the System

Our current economic model hinges on the scarcity of labor and knowledge. Human time and energy are limited, and expertise or access to quality information is hard-won. However, artificial intelligence is set to disrupt this foundation. With artificial general intelligence (AGI), knowledge becomes abundant—anyone can query a machine for expert-level answers. Wisdom and the ability to apply this information with discipline in real world applications, will become the deciding factor of who is successful in this future and who is not.

As robotics advance, labor scarcity will also disappear, with machines performing tasks with unmatched precision and stamina. An economy built on scarcity cannot thrive in a world of abundance. The transition will challenge markets, governments, and individuals in unprecedented ways, and what emerges next is uncertain. Those who combine abundant information with wisdom and adaptability will shape the future.

Hope, Preparation, and Ownership

This is not a doomsday message. The future could bring prosperity, creativity, and freedom like humanity has never experienced. But we can’t control which version of the future shows up—we can only prepare for it.

That preparation starts with ownership and action. Own the right assets. Learn the right strategies. Build a financial system that doesn’t rely on your time or a paycheck.

The AI revolution is coming. Don’t just watch it happen—make sure you’re ready.

My Current Long-Term Focus

As of May 2024, the core positions I’m targeting for long-term growth include:

Bitcoin / IBIT

Nvidia (NVDA)

Taiwan Semiconductor (TSM)

Tesla (TSLA)

Microsoft (MSFT)

These are my primary "set it and forget it" names. I also like names like AMD, MU, AVGO, and COIN for more active position trading, but these will likely require tighter risk management and more hands-on attention as that list fluctuates monthly based on charts and earnings.

These selections are deliberate, focusing exclusively on AI, semiconductors, and Bitcoin, as I believe excessive diversification dilutes exposure to the AI mega-trend. As Warren Buffett said, “Diversification is protection against ignorance. It makes little sense if you know what you are doing.” With disciplined risk management and options-based hedging, a concentrated portfolio in these sectors is manageable and a strategic hedge against future uncertainty. However, precise entry points are critical, and none of these names are currently in my buy zones. For detailed entry levels and live updates, join the All Access Pass or subscribe to the RLT Newsletter. Let’s get positioned and prepared. The next era of wealth is being built right now.

Market Milestones: AI Revolution

The Coming AI Revolution

Between now and the early 2030s, the world will undergo a transformation so rapid and far-reaching that our current understanding of business, work, economies, and power structures will be almost unrecognizable. Artificial intelligence isn’t just another wave of innovation—it’s a seismic shift in how humanity functions day to day.

We’re not just talking about task automation anymore. We’re entering a moment where both labor and knowledge—two cornerstones of today’s economy—are on the verge of becoming abundant. The only true constraint? Energy.

This level of disruption makes long-term predictions nearly impossible. The scale is too vast. But what we can do is prepare—and that starts by positioning ourselves wisely before the traditional human workforce is permanently changed.

Why This Decade Matters

The next five to ten years may be the final stretch where the economic system still resembles what we know. This is our window. Now is the time to earn aggressively, invest strategically, and accumulate assets that can thrive in a post-AI world.

I believe that a portfolio focused on stocks and Bitcoin—with concentrated exposure to AI leaders—can provide a path to financial independence before large swaths of the labor force are disrupted.

With the right positions in key names (which we’ll get to shortly), it’s possible to generate consistent monthly income—potentially enough to replace a typical W-2 salary. But it’s not just about buying assets at great levels, before things get totally bonkers. It’s equally important to develop the skills of trading and investing for income. Mastering risk management, hedging, and premium selling, while patiently buying low at key support zones, is what can truly pave the way to financial freedom.

At Real Life Trading, we teach and apply technical analysis alongside income-generating strategies like covered calls, cash-secured puts, collars, and more. These tools allow you to consistently extract income from your portfolio—even in a future where jobs could be scarce.

This Shift Is Bigger Than the Industrial Revolution

To grasp the stakes, think back to the Industrial Revolution. Yes, it replaced manual labor with machines—but it also created new jobs to absorb displaced workers. The AI revolution cuts deeper. We may see entire job categories vanish, with no clear replacements. This time, the disruption doesn’t just change what we do—it challenges what our role is in the economic machine.

Some sectors will disappear. Others will consolidate under companies that master AI. In that chaotic reshuffling, one thing is clear: owning shares in the companies driving the AI future is one of the smartest moves you can make.

Abundance Breaks the System

Our current economic model hinges on the scarcity of labor and knowledge. Human time and energy are limited, and expertise or access to quality information is hard-won. However, artificial intelligence is set to disrupt this foundation. With artificial general intelligence (AGI), knowledge becomes abundant—anyone can query a machine for expert-level answers. Wisdom and the ability to apply this information with discipline in real world applications, will become the deciding factor of who is successful in this future and who is not.

As robotics advance, labor scarcity will also disappear, with machines performing tasks with unmatched precision and stamina. An economy built on scarcity cannot thrive in a world of abundance. The transition will challenge markets, governments, and individuals in unprecedented ways, and what emerges next is uncertain. Those who combine abundant information with wisdom and adaptability will shape the future.

Hope, Preparation, and Ownership

This is not a doomsday message. The future could bring prosperity, creativity, and freedom like humanity has never experienced. But we can’t control which version of the future shows up—we can only prepare for it.

That preparation starts with ownership and action. Own the right assets. Learn the right strategies. Build a financial system that doesn’t rely on your time or a paycheck.

The AI revolution is coming. Don’t just watch it happen—make sure you’re ready.

My Current Long-Term Focus

As of May 2024, the core positions I’m targeting for long-term growth include:

Bitcoin / IBIT

Nvidia (NVDA)

Taiwan Semiconductor (TSM)

Tesla (TSLA)

Microsoft (MSFT)

These are my primary "set it and forget it" names. I also like names like AMD, MU, AVGO, and COIN for more active position trading, but these will likely require tighter risk management and more hands-on attention as that list fluctuates monthly based on charts and earnings.

These selections are deliberate, focusing exclusively on AI, semiconductors, and Bitcoin, as I believe excessive diversification dilutes exposure to the AI mega-trend. As Warren Buffett said, “Diversification is protection against ignorance. It makes little sense if you know what you are doing.” With disciplined risk management and options-based hedging, a concentrated portfolio in these sectors is manageable and a strategic hedge against future uncertainty. However, precise entry points are critical, and none of these names are currently in my buy zones. For detailed entry levels and live updates, join the All Access Pass or subscribe to the RLT Newsletter. Let’s get positioned and prepared. The next era of wealth is being built right now.

ABOUT REAL LIFE TRADING

We are a stock trading education company. Our goal is to teach and empower people to create generational wealth to enrich their lives and communities.

ONLINE TRAINING LINKS