Take Control of Your Financial Future

And Build the Life You Have Always Dreamed Of

Welcome to the RLT Newsletter

Helping Everyday Traders Beat the Market with Practical, Realistic Strategies

At the RLT Newsletter, our mission is simple: to educate and empower ordinary people to take control of their financial futures and manage their investments with confidence. We strive to help regular individuals like you invest and protect their hard-earned money to build a better life for themselves and their families.

Whether you're a beginner or a seasoned investor, our rules-based systems and clear analysis are designed to help you grow your wealth effectively—while giving you more time to focus on what truly matters in your life.

Struggling with Time, Knowledge, or Consistency?

Do you view investing as something that takes too much time, costs too much money, or feels too overwhelming to tackle on your own?

Maybe you can’t find the time to create trading plans, run scans, or set up alerts.

Are consistency and discipline your biggest hurdles, making it hard to stick to and follow a plan?

If this resonates with you,

The RLT Newsletter is here to help.

Our expert market analysis and proven, rules-based trading systems empower you to approach the stock market with confidence, discipline, and clarity. It’s time to overcome the challenges holding you back, face the market head-on, and come out victorious. The stock market is the best wealth creation device known to man and it’s time for you to start actively participating in it. Let us help you thrive!

Join the RLT Newsletter today to take back your time and secure your financial future.

Your Success, Our Mission: Empowering You to Win in the Market

Let Us Help You Succeed

Stay Informed: Receive 4 emails per week with market news and key price updates.

Follow Proven Systems:

Gain access to 4 live trading portfolios, updated in real-time.

Save Time:

Make adjustments to your portfolio in just minutes each day.

Gain Confidence: Learn from clear, concise charts and expert analysis tailored for all skill levels.

Master the Market:

Dive deep into technical analysis with insights on gap dynamics, macro trends, Fibonacci retracements, and Elliott Wave theory.

At Real Life Trading, we understand the challenges you’re facing, whether you’re just starting out or trying to break through to consistent profitability.

WHAT'S INCLUDED WITH THE RLT NEWSLETTER:

4 live trading portfolios:

Long-term Swing Trading

Long-term Investing

Momentum Trading

Short-term trading

4 weekly newsletters with trade alerts, stock picks, and market insights.

A weekly video featuring market rundowns and top stocks to watch.

On-demand support from an expert team of investors.

Portal access to track all actively managed portfolios.

Slack access to engage daily with our market analysts and the community.

Our Momentum Trading plan gets you exposure to the strongest stocks on the planet and helps you ride them higher for serious profits.

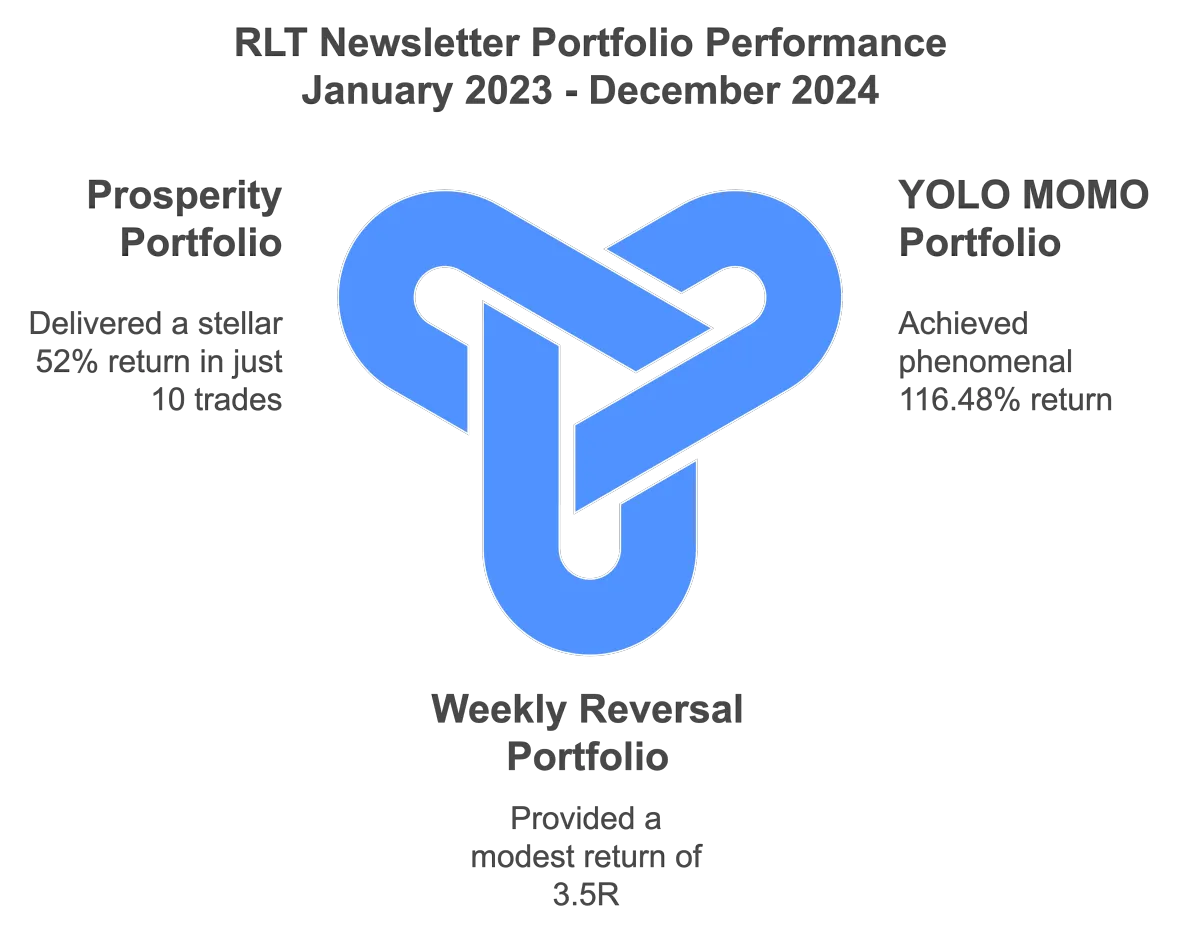

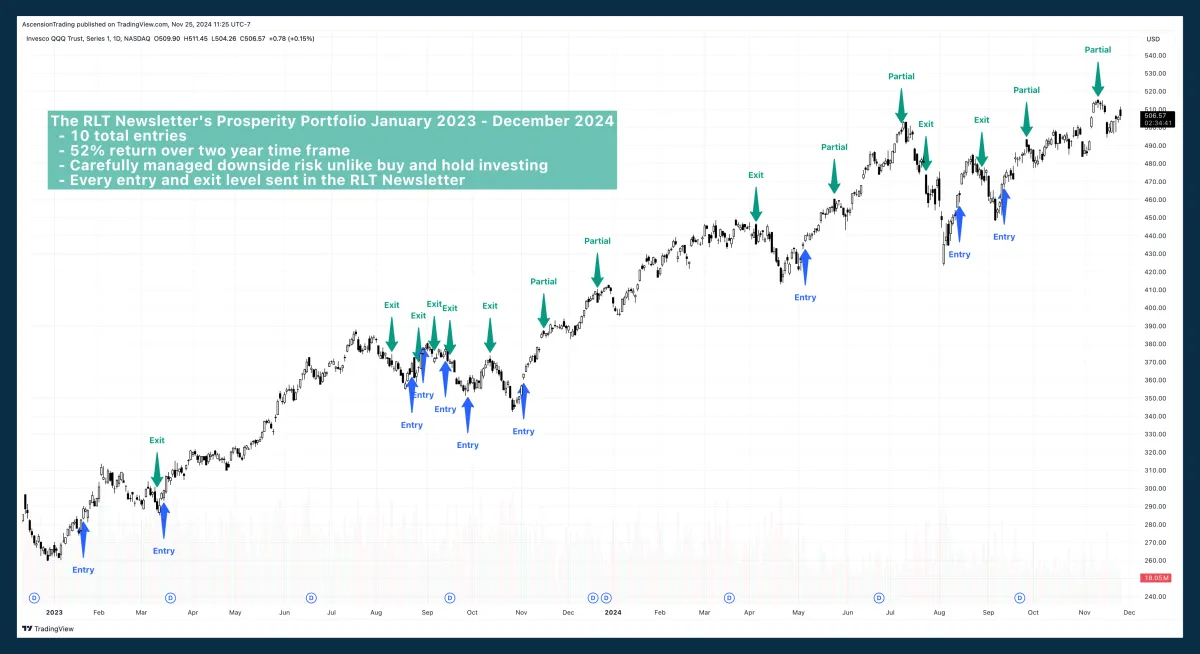

Our Prosperity Portfolio helps traders beat the market with just a few trades each year while managing downside risk. This slow and steady system is perfect for retirement accounts, long term trading accounts or anyone who wants amazing returns with very little time commitment.

Choose Excellence, Choose Results: Here’s Why We’re Your Best Bet

Our Promise to You

The Real Life Trading Newsletter stands apart from other financial publications by embracing a rules-based approach to the market and offering a genuine and realistic approach to the realities of trading. We recognize that trading entails both wins and losses, which is why we provide our members with straightforward, realistic expectations. Our commitment to transparency and authenticity combined with our sincere desire to empower our subscribers to reach their financial goals is what sets us apart. Join us as we take our trading skills and our trading accounts to the next level.

Don't Just Take Our Word For It...

Here's What Others Have To Say

Emails That Grow Your Wealth: How the RLT Newsletter Boosts Your Retirement Account and More

"Do you like "Mailbox Money"? What about great trade setups and ideas delivered straight to your email a few times a week? If your answer is yes, then you need to sign up for the RLT Newsletter. The YOLO MOMO and Prosperity Portfolio setups have been crushing the returns this year while managing risk. And every Tuesday, I get a video with some amazing chart analysis and trade ideas. My retirement account just keeps growing and it is all thanks to the RLT Newsletter!”

-Jason K.

From Confidence to Cash Flow: How the RLT Newsletter Transformed My Trading

"The RLT Newsletter is a great combination of technical analysis, trade ideas, and portfolio management. Both Yates and Jerremy are master technicians. I use the RLT Newsletter for short-term swing trade ideas and to practice my technical analysis. The Newsletter has increased my monthly cash flow, and it has given me the confidence to make my own trades based on the technical analysis provided. This Newsletter is an amazing value for the price. Highly recommended!”

-Chris W.

A Lifesaver for Busy Traders: How the RLT Newsletter Makes Every Hour Count

"I just can't stress enough how much I love your newsletters and how grateful I am for them. For a full time worker like myself that only has 1 hour a day to work on trading, it's a life saver! Thank you for all your time and effort putting them together!”

-Christopher W.

Finding the Perfect Fit: How the RLT Newsletter and Community Inspire Growth and Impact

"The RLT newsletter has been the right fit for me in the RLT community! I am hoping to continue to find ways to evolve, get more involved and use this education to change lives. Love your mission and the community of helpful people."

-Brian H.

Take the guesswork out of trading.

Gain the tools, insights, and support you need to succeed in the markets.

Just $59/Month

Frequently Asked Questions

How many emails will I receive each week?

You’ll receive 4 regular weekly emails on Monday, Tuesday, Thursday, and Friday. Additionally, you’ll receive occasional emails with portfolio updates as needed.

Can I cancel my monthly subscription anytime?

Yes! If you’re on the $59 monthly plan, you can cancel anytime, and your subscription will continue through the end of your current billing period.

Are the RLT Newsletter portfolios traded with live money?

No, all four RLT Newsletter portfolios are tracked in a simulated, paper trading account for educational and entertainment purposes only. Our goal is to teach traders how to manage risk and their own portfolios effectively. We are stock market educators, not financial advisors. If you need personalized financial advice, we strongly encourage you to consult a qualified financial professional.

Do the RLT Newsletter analysts take all the trades in the portfolios?

No, the analysts do not personally take every trade in the portfolios.

Are the stocks reviewed in the Tuesday Top Trade Video part of the 4 portfolios?

Not necessarily. While active or prospective trades for the portfolios may occasionally be discussed, the majority of the video focuses on general market reviews and stock charts that appear interesting from a technical analysis perspective.

What is the Prosperity Portfolio?

The Prosperity Portfolio is a long-term swing trading system that focuses exclusively on the QQQ. This long-only strategy aims to outperform the market by staying out during bearish periods and remaining invested during bullish trends. Unlike traditional buy-and-hold strategies, it actively manages downside risk, making it ideal for long-term investors seeking steady growth with reduced volatility. With only a handful of trades each year, it’s a time-efficient resource for those who want to grow their portfolio without the need for frequent trading.

What is the YOLO MOMO Portfolio?

YOLO, short for “you only live once,” paired with MOMO, short for “momentum,” defines the essence of the YOLO MOMO Portfolio. This momentum-driven, aggressive swing trading strategy focuses on capturing significant moves in the market’s strongest-performing tech stocks. With an emphasis on relative strength and excellent risk-reward setups, this system offers the potential for outsized returns. It comes with high volatility and large portfolio swings, making it an ideal resource for traders seeking aggressive growth and who are comfortable taking on higher levels of risk.

What is the RL Swing Stalker Portfolio?

The RL Swing Stalker Portfolio is a short-term swing trading system that leverages advanced market scans to uncover opportunities. Using the R system for precise risk management, this strategy takes both bullish and bearish trades to maximize profit potential. It’s an ideal resource for active traders looking for a system with well-defined risk parameters and frequent trading opportunities.

What is the HODL Hero’s Portfolio?

The HODL Hero’s Portfolio is a long-term investing strategy aimed at achieving substantial returns by holding high-quality stocks for extended periods. Risk is managed using advanced options strategies. This long-term portfolio does not use the R system for risk management, meaning it can experience larger drawdowns. This portfolio is a resource for long term investors focused on long-term growth and who are willing to embrace more volatility.

DISCLAIMER - PLEASE READ BEFORE MAKING ANY RLT NEWSLETTER TRADES

Disclaimer: Each portfolio in the RLT Newsletter is a hypothetical paper trading account. Real Life Trading and its analysts use these portfolios as an educational tool. It’s important to note that Real Life Trading nor its analysts are actively managing live, real-money portfolios. The analysts and moderators may or may not trade any of the given equities.

CFTC Rule 4.41: These results are based on hypothetical or simulated performance results with inherent limitations. Unlike actual performance records, these results do not represent real trading. Because these trades haven't been executed, the results may have under- or over-compensated for the impact of certain market factors, such as the lack of liquidity. Hypothetical or simulated trading programs are designed with the benefit of hindsight, and no representation is being made that any account will or is likely to achieve profits or losses similar to those shown.

Trading Risks: Real Life Trading LLC (“Company”) is not an investment advisory service, nor a registered investment advisor or broker-dealer and does not purport to tell or suggest which securities customers should buy or sell for themselves. The independent contractors, employees or affiliates of Company may hold positions in the stocks, options, currencies or industries discussed here. You understand and acknowledge that there is a very high degree of risk involved in trading securities, options and/or currencies. The Company assumes no responsibility or liability for your trading and investment results. It should not be assumed that the methods, techniques, or indicators presented will be profitable or that they will not result in losses. Past results of any individual trader or trading system presented by the Company are not indicative of future returns by that trader or system, and are not indicative of future returns which will be realized by you. In addition, the indicators, strategies, and all other features of Company’s products (collectively, the “Information”) are provided for informational and educational purposes only and should not be construed as investment advice.

MONEY MAKING BLOGS

Market Milestones: Bull vs Bear

As many of you know, I've been scaling out of positions as this rally has progressed. To be honest, I did not expect Monday’s massive gap—it caught me off guard and had me wishing my holding muscles were a bit stronger. No one is immune to FOMO, and I’ll admit, I felt it a bit this week.

But here's the difference between successful and unsuccessful traders: successful traders don’t let FOMO override their plans. They stick to their process and diligently plan their next moves.

It might sometimes look like I’m making market predictions and then being right or wrong based on those predictions. But in reality, I’m not trying to predict anything. I’m setting up scenarios based on probabilities and mapping out what I’ll do in each case. That’s our job as traders: react to what the market gives us—not to try and guess what it will do. If our success depended on knowing the future, we’d all be in serious trouble.

This week’s gap up and strong follow through after the extremely bullish push from the lows shows us that the bulls are here and ready to fight tooth and nail for higher prices. The news has not been that spectacular and we are now well above the Liberation Day levels. This kind of price action weakens the case that this was just a bear market rally off the lows. I’ve been leaning that way for a while, but the market grinding higher day after day is making that less and less probable right now.

That said, I still expect a decent correction at some point. I think the bulls buying right now and chasing this move higher will eventually get shaken out in a pullback that resets the metaphorical rubber band and sets us up for a push to new all-time highs later this year.

However, if we gap below the strong support level at $575 and then start dropping vertically, that would be a big red flag—and it would seriously make me question whether this entire move was just a very sneaky bear market rally in disguise.

Let's break down the arguments for both the bulls and the bears right now.

The Bull Case: Riding the Momentum

Sheer Power of the Rally: The bullish move that ignited from the April 7th lows is undeniable in its strength and momentum.

Strong Support Levels: The SPY now boasts significant support in the form of the 100-day and 200-day SMAs, coupled with that crucial horizontal support at $575.00.

Key Resistance Breached: The upward push has decisively gaped above and broken through important resistance levels.

Bull Market Trendline Reclaimed: The QQQ has successfully reclaimed its bull market trendline.

Deep Retracement: The recent rally has retraced a larger portion of the previous decline than typically seen in a standard bear market correction.

Historical Precedent: One of the most fundamental tendencies of the stock market is its long-term up and to the right direction.

Individual Stock Strength: Many charts, like Microsoft (MSFT), suggest that individual stocks have completed their corrections and are resuming their journey back to new all-time highs.

Dollar Debasement: The ongoing and likely accelerating debasement of the US dollar due to massive debt will continue to funnel money into hard assets, including equities and crypto. It’s the only way to escape the debasement.

Market-Responsive Administration: The current administration has shown a willingness to listen to market signals, as evidenced by their pivot on April 7th due to bond market pressures. They also have a vested interest in a strong stock market as a measure of their policy success.

Favorable Timeline: The current pause on tariffs and the focus on positive trade negotiations create a supportive environment for the market at least until July 9th when the tariff pause ends.

Anticipated Dip Buying: When the inevitable dip occurs, strong buying interest is likely to emerge at key SPY levels like $575, $550, and $530.

SPY Bull Chart

The Bear Case: Lingering Concerns

Corrective Pattern: From a technical perspective, the rally off the lows still exhibits characteristics of a corrective three-wave wedge pattern, which typically resolves to the downside.

Echoes of 2022: While this week's action has differentiated it, the initial bounce shared striking similarities with the first bear market bounce of the 2022 correction.

Waning Volume: The volume supporting this rally has been decreasing, which can be a sign of weakening conviction, and a correction.

Greedy Sentiment: Market sentiment has swung back towards greed, potentially allowing larger players to sell into this exuberance at elevated prices.

Uncertainty in the Bond Market: The bond market remains uneasy, with TLT testing its lows as buyers remain hesitant despite lower inflation – perhaps signaling deeper concerns about the debt situation and potential future inflation.

Debt Refinancing Challenge: The US faces the daunting task of refinancing $10 trillion in debt this year, and rising yields (like the 20-year testing 5.0%) will lead to significantly higher debt payments.

QE Dilemma: If the Federal Reserve steps in with quantitative easing (QE) to support the bond market, it risks reigniting inflation—further discouraging bond buyers and creating a vicious cycle of expanding QE and ballooning government debt. While this could ultimately propel equities higher due to massive money printing, the early stages of this scenario would likely act as a bearish catalyst.

SPY Bear Chart

Navigating the Path Ahead: Planning Our Moves

Given that the current probabilities favor the next dip being a buying opportunity (with a lower chance of a significant breakdown), now is the time to strategize our entry points, target buy levels, and set our stop and alert levels. As long as we manage risk effectively, the next pullback should offer a compelling risk-reward scenario heading into the summer and early fall.

However, we must remain vigilant. A sharp, vertical drop triggered by negative news could quickly shift the probabilities towards a retest of the lows or even a deeper correction. We'll be closely monitoring the nature of any pullbacks in the coming weeks.

Personally, I'm looking to buy the dip in Bitcoin (BTC), as well as fundamentally strong names like Microsoft (MSFT), Meta (META), Taiwan Semiconductor Manufacturing (TSM), Tesla (TSLA), Micron (MU), and potentially Advanced Micro Devices (AMD).

Stay nimble, manage your risk, and let's see how the market unfolds!

BTCUSD

Market Milestones: Bull vs Bear

As many of you know, I've been scaling out of positions as this rally has progressed. To be honest, I did not expect Monday’s massive gap—it caught me off guard and had me wishing my holding muscles were a bit stronger. No one is immune to FOMO, and I’ll admit, I felt it a bit this week.

But here's the difference between successful and unsuccessful traders: successful traders don’t let FOMO override their plans. They stick to their process and diligently plan their next moves.

It might sometimes look like I’m making market predictions and then being right or wrong based on those predictions. But in reality, I’m not trying to predict anything. I’m setting up scenarios based on probabilities and mapping out what I’ll do in each case. That’s our job as traders: react to what the market gives us—not to try and guess what it will do. If our success depended on knowing the future, we’d all be in serious trouble.

This week’s gap up and strong follow through after the extremely bullish push from the lows shows us that the bulls are here and ready to fight tooth and nail for higher prices. The news has not been that spectacular and we are now well above the Liberation Day levels. This kind of price action weakens the case that this was just a bear market rally off the lows. I’ve been leaning that way for a while, but the market grinding higher day after day is making that less and less probable right now.

That said, I still expect a decent correction at some point. I think the bulls buying right now and chasing this move higher will eventually get shaken out in a pullback that resets the metaphorical rubber band and sets us up for a push to new all-time highs later this year.

However, if we gap below the strong support level at $575 and then start dropping vertically, that would be a big red flag—and it would seriously make me question whether this entire move was just a very sneaky bear market rally in disguise.

Let's break down the arguments for both the bulls and the bears right now.

The Bull Case: Riding the Momentum

Sheer Power of the Rally: The bullish move that ignited from the April 7th lows is undeniable in its strength and momentum.

Strong Support Levels: The SPY now boasts significant support in the form of the 100-day and 200-day SMAs, coupled with that crucial horizontal support at $575.00.

Key Resistance Breached: The upward push has decisively gaped above and broken through important resistance levels.

Bull Market Trendline Reclaimed: The QQQ has successfully reclaimed its bull market trendline.

Deep Retracement: The recent rally has retraced a larger portion of the previous decline than typically seen in a standard bear market correction.

Historical Precedent: One of the most fundamental tendencies of the stock market is its long-term up and to the right direction.

Individual Stock Strength: Many charts, like Microsoft (MSFT), suggest that individual stocks have completed their corrections and are resuming their journey back to new all-time highs.

Dollar Debasement: The ongoing and likely accelerating debasement of the US dollar due to massive debt will continue to funnel money into hard assets, including equities and crypto. It’s the only way to escape the debasement.

Market-Responsive Administration: The current administration has shown a willingness to listen to market signals, as evidenced by their pivot on April 7th due to bond market pressures. They also have a vested interest in a strong stock market as a measure of their policy success.

Favorable Timeline: The current pause on tariffs and the focus on positive trade negotiations create a supportive environment for the market at least until July 9th when the tariff pause ends.

Anticipated Dip Buying: When the inevitable dip occurs, strong buying interest is likely to emerge at key SPY levels like $575, $550, and $530.

SPY Bull Chart

The Bear Case: Lingering Concerns

Corrective Pattern: From a technical perspective, the rally off the lows still exhibits characteristics of a corrective three-wave wedge pattern, which typically resolves to the downside.

Echoes of 2022: While this week's action has differentiated it, the initial bounce shared striking similarities with the first bear market bounce of the 2022 correction.

Waning Volume: The volume supporting this rally has been decreasing, which can be a sign of weakening conviction, and a correction.

Greedy Sentiment: Market sentiment has swung back towards greed, potentially allowing larger players to sell into this exuberance at elevated prices.

Uncertainty in the Bond Market: The bond market remains uneasy, with TLT testing its lows as buyers remain hesitant despite lower inflation – perhaps signaling deeper concerns about the debt situation and potential future inflation.

Debt Refinancing Challenge: The US faces the daunting task of refinancing $10 trillion in debt this year, and rising yields (like the 20-year testing 5.0%) will lead to significantly higher debt payments.

QE Dilemma: If the Federal Reserve steps in with quantitative easing (QE) to support the bond market, it risks reigniting inflation—further discouraging bond buyers and creating a vicious cycle of expanding QE and ballooning government debt. While this could ultimately propel equities higher due to massive money printing, the early stages of this scenario would likely act as a bearish catalyst.

SPY Bear Chart

Navigating the Path Ahead: Planning Our Moves

Given that the current probabilities favor the next dip being a buying opportunity (with a lower chance of a significant breakdown), now is the time to strategize our entry points, target buy levels, and set our stop and alert levels. As long as we manage risk effectively, the next pullback should offer a compelling risk-reward scenario heading into the summer and early fall.

However, we must remain vigilant. A sharp, vertical drop triggered by negative news could quickly shift the probabilities towards a retest of the lows or even a deeper correction. We'll be closely monitoring the nature of any pullbacks in the coming weeks.

Personally, I'm looking to buy the dip in Bitcoin (BTC), as well as fundamentally strong names like Microsoft (MSFT), Meta (META), Taiwan Semiconductor Manufacturing (TSM), Tesla (TSLA), Micron (MU), and potentially Advanced Micro Devices (AMD).

Stay nimble, manage your risk, and let's see how the market unfolds!

BTCUSD

ABOUT REAL LIFE TRADING

We are a stock trading education company. Our goal is to teach and empower people to create generational wealth to enrich their lives and communities.

ONLINE TRAINING LINKS