Market Milestones: Chips & Dips

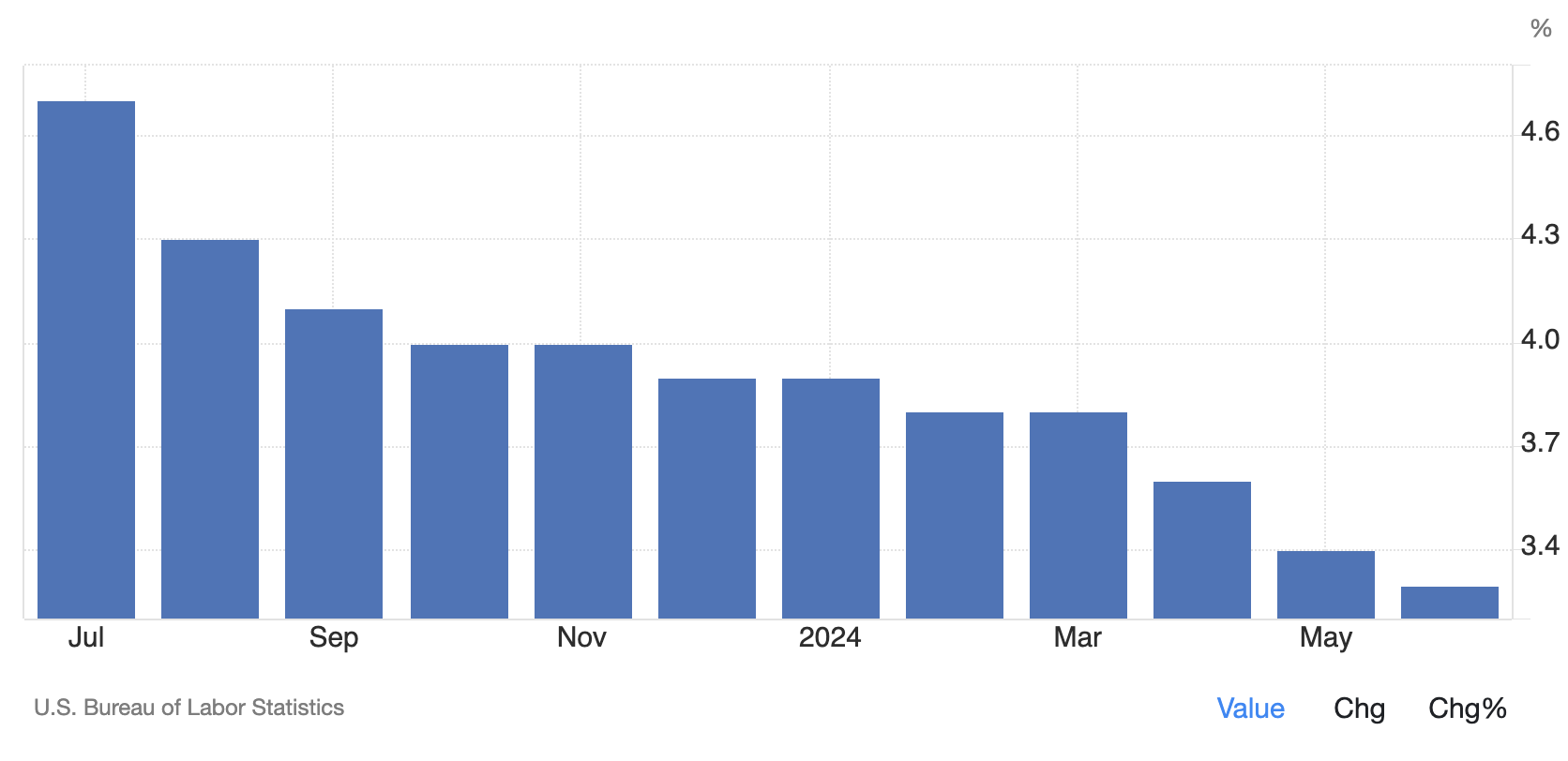

Thursday’s inflation numbers came in even lower than expected, with CPI falling to 3.0% and Core CPI hitting a three-year low of 3.3%. This ignited rate cut talk and essentially ensured a rate cut in 2024. The question of when that cut comes and how many we get is still up in the air. The market is assuming rates will remain unchanged in July, with a high likelihood of the first cut coming in September. The market is now thinking that the Fed will cut rates at the November meeting and possibly the December meeting as well.

CORE CPI

The question has shifted from when will rate cuts happen, to what happens when rate cuts arrive? History is mixed on the subject, and the economic factors involved with each rate cut vary drastically, but we can still garner some insight by looking at the charts. Many variations of this chart have been all over X in an effort to prove one point or the other—either we crash or go to the moon, generally the former. The data shows that stocks moved lower, at least in the short term, six times since 1965 when the federal funds rate was cut. It also shows that stocks moved higher four times during that same period. Since the 1989 rate cuts produced a 20-month long sideways market that started with a bit of a bullish pump, that one could go either way making it a five-to-five tie on whether stocks moved up or down after rate cuts. Also, the 2019 rate hikes did produce a blow-off top of nearly 15% in seven months before the markets gave it all back with a 35% correction during the Covid crash. That data point could go either way as well.

SPX & THE FED FUNDS RATE

All this is to say that rate cuts by themselves do not inherently cause the market to go up or down, despite what you may hear in the coming months. It is the circumstances surrounding them that causes the market to either crash or run bullish. Rate cuts can be a response from the Fed once something in the economy is broken, which generally leads to a drop in the market. However, if Jerome Powell and the "Money Boys" gang are able to engineer a soft landing, that should lead to a rise in stock prices after the rate cuts. Either way, JP and the "Money Boys" have been itching to cut rates, and Thursday's CPI numbers have given them all the justification they need to inject some more of that sweet, sweet stimmy into the market.

Gold looks like it is on the verge of a breakout from its 3-month channel. NVDA, AVGO, and AMZN all have recently shown what happens when a stock breaks through a multi-month level of resistance. As a matter of fact, gold and silver both broke out of much larger consolidation periods earlier this year, and ran higher. Both gold (IAU) and silver (SLV) look like they are ready to continue their bullish moves higher.

iShares Gold Trust (IAU)

While gold and silver look poised for another bullish run, the chips which have been leading this market, look like they are ready for some dip. NVDA, AVGO, MU, and QCOM, past market leaders, did not make a higher high alongside the market. However, TSM, LRCX, AMAT, and ARM did make higher highs along with big tech and the market. Higher high or not, all the semiconductors saw a massive drop on Thursday, with many dropping 5% or more. AVGO has a stock split today, meaning that on Monday you can buy 100 shares of AVGO for less than $20,000! If dip buyers are lucky, the split will help it fill its gap from 6/12/24 and make AVGO a $150 stock once again.

The sector as a whole is very strong, and dips will be buyable if they are deep enough. SMH once again came within a few dollars of its upper trend line while huge bearish divergence appeared in the RSI. Watch for SMH to retest its 100SMA, or even the 200SMA if the bears can sink their claws in for a while. The 200DSMA also lines up with a solid support and the gap fill from 2/21/24. It would take a 30% drawdown to get there, which is possible if the market decides to take a dive on rate cut news.

SMH

ABOUT REAL LIFE TRADING

We are a stock trading education company. Our goal is to teach and empower people to create generational wealth to enrich their lives and communities.

ONLINE TRAINING LINKS