START TRADING WITH CONFIDENCE

JOIN A COMMUNITY COMMITTED TO YOUR SUCCESS

Are you new to trading and ready to make your mark? Or do you have experience but are struggling to become a consistently profitable trader?

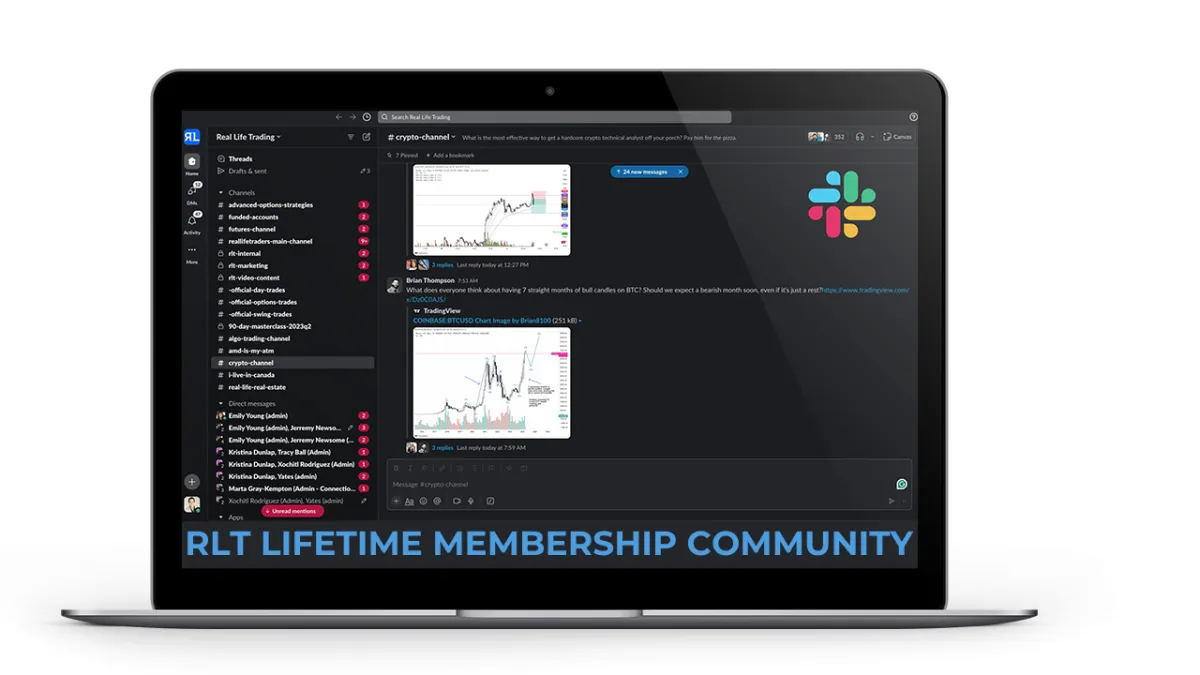

Imagine having a community of like-minded traders and experts at your side, helping you navigate every step of the journey!

Join us and gain lifetime access to our exclusive Slack community—where you’ll find real-time support, valuable insights, and camaraderie with fellow traders. With FREE monthly courses and weekly live education sessions, we’re here to guide you every step of the way. Whether you're just starting out or looking to enhance your skills, you’ll have the tools and community you need to trade with confidence.

Start your journey today with a community dedicated to your success with a one-time $25 investment!

CREATE CASH FLOW AND KEEP IT

RETIRE EARLY AND LIVE THE LIFE YOU WANT

We teach people how to make money from the stock and crypto markets and KEEP IT by following simple and proven strategies that have generated $10,000,000+ for our customers and their families.

Tired of working for someone else? Dream of trading full-time?

Now’s your chance to make it happen!

Become a Full-Time Trader in 2025 with Tony Pawlak's

Elite 10-Month Premier Coaching Program !

Registration Only Opened Once a Year!

This isn’t just another program —

it’s a proven pathway to success. Over the years, Tony has helped countless students quit their jobs and transition into full-time trading. Through personalized coaching and hands-on training, he will guide you step by step to ensure you not only learn, but master the essential skills needed to consistently win in the markets.

AS FEATURED IN

Want to Trade LIVE with other TRADERS?

Get signed up for our immersive, high-energy, active stock trading rooms.

You'll get detailed insights on entries, exits, targets, and explanations.

We answer viewer questions in real time.

Get All Access to All Live Trading Rooms + Slack + RLT Newsletter

Just $275/Month - Best Value

Real-time trades you can follow

Exclusive Weekly Mentorships

Expert 1:1 trading support on demand

Access to a private slack group

Access to an incredible community of RLT traders to support you on your journey

Get access to live day trade & swing trading rooms

Live practice sessions/drills and strategies + get real-time feedback

Live market recaps and analysis

Weekly Q&A session to review your trades and answer your trading questions.

RLT Newsletter with trade alerts, stock picks and market analysis

Live Day Trading Room

Just $179/Month

Real-time trades you can follow

Expert 1:1 trading support on demand

Access to an incredible community of RLT traders

Get access to our live day trading room

Live practice sessions/drills and strategies + get real-time feedback

Live market recaps and analysis

Live SWING Trading Room

Just $149/Month

Real-time trades you can follow

Expert 1:1 trading support on demand

Access to an incredible community of RLT traders

Get access to our live swing trading room

Live practice sessions/drills and strategies + get real-time feedback

Live market recaps and analysis

RLT Education Programs

Mentorships

Unlock Your Trading Potential with

Funded Trading

Do you have the skills to trade, but lack the capital to make your mark in the markets?

Funded trading could be the solution you've been waiting for. With funded trading, you can trade with the backing of a funding company who will provide you with the trading capital, allowing you to focus on your strategy without the burden of risking your own capital.

Apex Trader Funding was established in

2021 with the goal of revolutionizing the trader payout model. It was founded out of dissatisfaction with existing funding companies and a desire to adopt a more customer-centric approach. As a premier trader funding company, Apex Trader Funding (ATF) outperforms other futures funding evaluation firms in terms of payouts. With a vast global community spanning over 150 countries and tens of thousands of members, Apex Trader Funding, headquartered in Austin, Texas, specializes in funding evaluations for futures markets.

Receive 100% of the first $25,000 per Account and 90% Beyond That

Two Payouts per Month

Trade Full-Sized Contracts in Evaluations or Funded Accounts

No Scaling or Failing by Going Over Contract Size

No Daily Drawdowns

Trade on Holidays

Trade Your Normal Day-to-Day Strategy or System During The News

No Total Cap on Maximum Payout

One-Step Evaluation Process

Real-Time Data Included

Simple Risk Management Rules

Trade With Multiple Accounts up to 20 max

If you’re a trader with the knowledge and skill but are held back by limited capital, Apex Trader Funding offers you the chance to access the capital you need to trade confidently.

Join the revolution in trading today with Apex Trader Funding, where your potential is funded, and your success is our priority.

FREE TRADING RESOURCES

Take FREE online courses to learn how to earn extra income while keeping your day job, Paying off debt, investing in your future, and Retiring Early

BEGINNER GUIDE TO DAY TRADING COURSE

FREE

BEGINNER GUIDE TO SWING TRADING COURSE

FREE

BEGINNER GUIDE TO INVESTING COURSE

FREE

GET TRADE ALERTS

Just $59/Month

Are you unable to find the time to build your own trading plans, do your own scans, or set up your own alerts? If so, our systems have you covered. Seize this opportunity to establish yourself as a consistent and disciplined trader and grow your trading account. Begin your journey today by subscribing to the RLT Newsletter.

MONEY MAKING BLOGS

Market Milestones: HODL the Line

The SPY and QQQ saw some intraday selling on Thursday, but by the close, bulls had driven them back near the open, finishing with bearish hammers. The bulls keep showing up where they need to and are relentlessly buying the dip. SPY looks ready for another wave higher into the $630 region. A gap-up or a strong bullish candle will be needed for some momentum to push this move forward. A few of the Magnificent 7 sit at precarious levels where a bullish gap could kick off their next leg higher, most notably GOOGL, TSLA, NVDA and MSFT. If, instead, these names and the rest of big tech gap down, SPY could see one more solid retest before a nice move higher into summer.

GOOGL

As we stand right now, SPY, QQQ, and BTC charts all have me leaning cautiously bullish. BTC has been holding key support levels for months, and SPY’s Thursday low bounced exactly where it needed to. Key support on SPY is $603.00, and BTC’s key level is $92,000. A breakdown below those levels could trigger a sharp flush lower, creating a strong buying opportunity. As long as those supports hold, the market looks set to continue its slow grind higher.

SPY

I know I talk about Bitcoin a lot—probably too much if you’re not a fan—but get ready for another Bitcoin-heavy newsletter. IBIT remains my favorite vehicle for simple and easy Bitcoin exposure, and realistically, it’s the ETFs along with Strategy (MSTR) that are driving Bitcoin’s price action right now. On that note, how wild is it that Strategy (MSTR) will soon hold 500,000 Bitcoin? Even crazier, if the U.S. Strategic Bitcoin Reserve bill passes in its purest form, the U.S. could be buying as much as 1 million Bitcoin over the next several years. This is the next major catalyst Bitcoiners are betting on and if it doesn’t happen, we could see a severe correction. However, don’t get too bearish just yet as Bitcoin isn’t short on bullish catalysts right now.

Texas, the eighth-largest economy in the world, is pushing for its own strategic Bitcoin reserve, with plans to buy $500 million worth per year. At least 31 states have introduced similar bills, making a federal adoption even more likely. Adding to the bullish case, Howard Lutnick, a major Bitcoin holder with hundreds of millions in BTC, was just confirmed as the new Secretary of Commerce.

IBIT

As mentioned above IBIT remains a great option for direct Bitcoin exposure, and it’s arguably even better than spot Bitcoin for many people. Since IBIT became the most successful ETF launch in history, a wave of new products has followed. One that caught my attention is the NEOS Bitcoin High Income ETF (BTCI). Generally, I avoid high-income covered call ETFs, but I occasionally dabble for exposure and fun.

BTCI is an interesting product, possibly more so than some of the newer downside protection ETFs from Calamos (CBOJ, CBXJ, CBTJ). Those are worth considering for investors who want built-in risk protection, though I believe stops and protective puts work just as well—if not better—which is why BTCI intrigues me more. It’s currently set up to yield a 30% annual distribution, paid out monthly through covered call sales.

Diving into BTCI’s structure, is fascinating—not because it’s unique in the covered call ETF space, but because Bitcoin’s inherent volatility provides substantial premium opportunities. BTCI allocates 24% of its funds to HODL, the VanEck Bitcoin ETF, for direct upside exposure. It also establishes synthetic long positions by selling puts and buying calls at the same strike price. These synthetic longs are then used to sell covered calls against in order to generate the monthly income.

The fund charges a 0.98% expense ratio, which is high, but if it achieves a near-30% distribution rate, that’s a reasonable trade-off. Traders could mirror this strategy independently using IBIT and its options chain or simply buy BTCI and let the fund execute it for them. Synthetic longs work well in bullish or sideways markets but can be rough in bear markets. I plan to pick up a few shares of BTCI to see how it performs. For what it’s worth, the counterparty risk here is higher than that of IBIT, a BlackRock product. If you’re interested in tracking the synthetic longs I’ll be entering on IBIT over the coming months, make sure to subscribe to our RLT Newsletter.

BTCI

One final note on Bitcoin at this level: while the bulls have fiercely defended the $92,000 support, a flush lower into the $80,000 range is still very possible. That said, barring a black swan event, I don’t see Bitcoin dropping much below $80,000 at this stage of the cycle. If we do see a price that starts with an 8, it will likely be the last true buying opportunity of this cycle. I also believe Bitcoin and SPY will move together in this next leg—whichever direction that may be—so keep a close eye on BTC, especially over the weekends.

BTCUSD

Market Milestones: HODL the Line

The SPY and QQQ saw some intraday selling on Thursday, but by the close, bulls had driven them back near the open, finishing with bearish hammers. The bulls keep showing up where they need to and are relentlessly buying the dip. SPY looks ready for another wave higher into the $630 region. A gap-up or a strong bullish candle will be needed for some momentum to push this move forward. A few of the Magnificent 7 sit at precarious levels where a bullish gap could kick off their next leg higher, most notably GOOGL, TSLA, NVDA and MSFT. If, instead, these names and the rest of big tech gap down, SPY could see one more solid retest before a nice move higher into summer.

GOOGL

As we stand right now, SPY, QQQ, and BTC charts all have me leaning cautiously bullish. BTC has been holding key support levels for months, and SPY’s Thursday low bounced exactly where it needed to. Key support on SPY is $603.00, and BTC’s key level is $92,000. A breakdown below those levels could trigger a sharp flush lower, creating a strong buying opportunity. As long as those supports hold, the market looks set to continue its slow grind higher.

SPY

I know I talk about Bitcoin a lot—probably too much if you’re not a fan—but get ready for another Bitcoin-heavy newsletter. IBIT remains my favorite vehicle for simple and easy Bitcoin exposure, and realistically, it’s the ETFs along with Strategy (MSTR) that are driving Bitcoin’s price action right now. On that note, how wild is it that Strategy (MSTR) will soon hold 500,000 Bitcoin? Even crazier, if the U.S. Strategic Bitcoin Reserve bill passes in its purest form, the U.S. could be buying as much as 1 million Bitcoin over the next several years. This is the next major catalyst Bitcoiners are betting on and if it doesn’t happen, we could see a severe correction. However, don’t get too bearish just yet as Bitcoin isn’t short on bullish catalysts right now.

Texas, the eighth-largest economy in the world, is pushing for its own strategic Bitcoin reserve, with plans to buy $500 million worth per year. At least 31 states have introduced similar bills, making a federal adoption even more likely. Adding to the bullish case, Howard Lutnick, a major Bitcoin holder with hundreds of millions in BTC, was just confirmed as the new Secretary of Commerce.

IBIT

As mentioned above IBIT remains a great option for direct Bitcoin exposure, and it’s arguably even better than spot Bitcoin for many people. Since IBIT became the most successful ETF launch in history, a wave of new products has followed. One that caught my attention is the NEOS Bitcoin High Income ETF (BTCI). Generally, I avoid high-income covered call ETFs, but I occasionally dabble for exposure and fun.

BTCI is an interesting product, possibly more so than some of the newer downside protection ETFs from Calamos (CBOJ, CBXJ, CBTJ). Those are worth considering for investors who want built-in risk protection, though I believe stops and protective puts work just as well—if not better—which is why BTCI intrigues me more. It’s currently set up to yield a 30% annual distribution, paid out monthly through covered call sales.

Diving into BTCI’s structure, is fascinating—not because it’s unique in the covered call ETF space, but because Bitcoin’s inherent volatility provides substantial premium opportunities. BTCI allocates 24% of its funds to HODL, the VanEck Bitcoin ETF, for direct upside exposure. It also establishes synthetic long positions by selling puts and buying calls at the same strike price. These synthetic longs are then used to sell covered calls against in order to generate the monthly income.

The fund charges a 0.98% expense ratio, which is high, but if it achieves a near-30% distribution rate, that’s a reasonable trade-off. Traders could mirror this strategy independently using IBIT and its options chain or simply buy BTCI and let the fund execute it for them. Synthetic longs work well in bullish or sideways markets but can be rough in bear markets. I plan to pick up a few shares of BTCI to see how it performs. For what it’s worth, the counterparty risk here is higher than that of IBIT, a BlackRock product. If you’re interested in tracking the synthetic longs I’ll be entering on IBIT over the coming months, make sure to subscribe to our RLT Newsletter.

BTCI

One final note on Bitcoin at this level: while the bulls have fiercely defended the $92,000 support, a flush lower into the $80,000 range is still very possible. That said, barring a black swan event, I don’t see Bitcoin dropping much below $80,000 at this stage of the cycle. If we do see a price that starts with an 8, it will likely be the last true buying opportunity of this cycle. I also believe Bitcoin and SPY will move together in this next leg—whichever direction that may be—so keep a close eye on BTC, especially over the weekends.

BTCUSD

ABOUT REAL LIFE TRADING

We are a stock trading education company. Our goal is to teach and empower people to create generational wealth to enrich their lives and communities.

ONLINE TRAINING LINKS