START TRADING WITH CONFIDENCE

JOIN A COMMUNITY COMMITTED TO YOUR SUCCESS

Are you new to trading and ready to make your mark? Or do you have experience but are struggling to become a consistently profitable trader?

Imagine having a community of like-minded traders and experts at your side, helping you navigate every step of the journey!

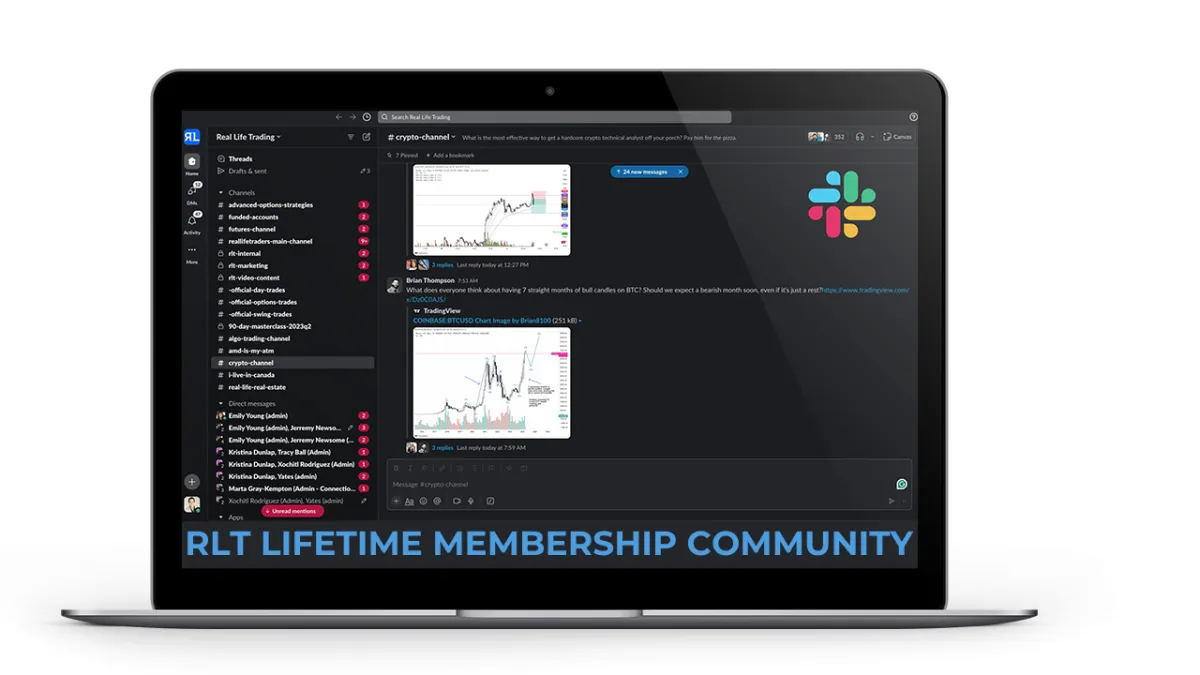

Join us and gain lifetime access to our exclusive Slack community—where you’ll find real-time support, valuable insights, and camaraderie with fellow traders. With FREE monthly courses and weekly live education sessions, we’re here to guide you every step of the way. Whether you're just starting out or looking to enhance your skills, you’ll have the tools and community you need to trade with confidence.

Start your journey today with a community dedicated to your success with a one-time $25 investment!

CREATE CASH FLOW AND KEEP IT

RETIRE EARLY AND LIVE THE LIFE YOU WANT

We teach people how to make money from the stock and crypto markets and KEEP IT by following simple and proven strategies that have generated $10,000,000+ for our customers and their families.

Tired of working for someone else? Dream of trading full-time?

Now’s your chance to make it happen!

Become a Full-Time Trader in 2025 with Tony Pawlak's

Elite 10-Month Premier Coaching Program !

Registration Only Opened Once a Year!

This isn’t just another program —

it’s a proven pathway to success. Over the years, Tony has helped countless students quit their jobs and transition into full-time trading. Through personalized coaching and hands-on training, he will guide you step by step to ensure you not only learn, but master the essential skills needed to consistently win in the markets.

AS FEATURED IN

Want to Trade LIVE with other TRADERS?

Get signed up for our immersive, high-energy, active stock trading rooms.

You'll get detailed insights on entries, exits, targets, and explanations.

We answer viewer questions in real time.

Get All Access to All Live Trading Rooms + Slack + RLT Newsletter

Just $275/Month - Best Value

Real-time trades you can follow

Exclusive Weekly Mentorships

Expert 1:1 trading support on demand

Access to a private slack group

Access to an incredible community of RLT traders to support you on your journey

Get access to live day trade & swing trading rooms

Live practice sessions/drills and strategies + get real-time feedback

Live market recaps and analysis

Weekly Q&A session to review your trades and answer your trading questions.

RLT Newsletter with trade alerts, stock picks and market analysis

Live Day Trading Room

Just $179/Month

Real-time trades you can follow

Expert 1:1 trading support on demand

Access to an incredible community of RLT traders

Get access to our live day trading room

Live practice sessions/drills and strategies + get real-time feedback

Live market recaps and analysis

Live SWING Trading Room

Just $149/Month

Real-time trades you can follow

Expert 1:1 trading support on demand

Access to an incredible community of RLT traders

Get access to our live swing trading room

Live practice sessions/drills and strategies + get real-time feedback

Live market recaps and analysis

RLT Education Programs

Mentorships

Unlock Your Trading Potential with

Funded Trading

Do you have the skills to trade, but lack the capital to make your mark in the markets?

Funded trading could be the solution you've been waiting for. With funded trading, you can trade with the backing of a funding company who will provide you with the trading capital, allowing you to focus on your strategy without the burden of risking your own capital.

Apex Trader Funding was established in

2021 with the goal of revolutionizing the trader payout model. It was founded out of dissatisfaction with existing funding companies and a desire to adopt a more customer-centric approach. As a premier trader funding company, Apex Trader Funding (ATF) outperforms other futures funding evaluation firms in terms of payouts. With a vast global community spanning over 150 countries and tens of thousands of members, Apex Trader Funding, headquartered in Austin, Texas, specializes in funding evaluations for futures markets.

Receive 100% of the first $25,000 per Account and 90% Beyond That

Two Payouts per Month

Trade Full-Sized Contracts in Evaluations or Funded Accounts

No Scaling or Failing by Going Over Contract Size

No Daily Drawdowns

Trade on Holidays

Trade Your Normal Day-to-Day Strategy or System During The News

No Total Cap on Maximum Payout

One-Step Evaluation Process

Real-Time Data Included

Simple Risk Management Rules

Trade With Multiple Accounts up to 20 max

If you’re a trader with the knowledge and skill but are held back by limited capital, Apex Trader Funding offers you the chance to access the capital you need to trade confidently.

Join the revolution in trading today with Apex Trader Funding, where your potential is funded, and your success is our priority.

FREE TRADING RESOURCES

Take FREE online courses to learn how to earn extra income while keeping your day job, Paying off debt, investing in your future, and Retiring Early

BEGINNER GUIDE TO DAY TRADING COURSE

FREE

BEGINNER GUIDE TO SWING TRADING COURSE

FREE

BEGINNER GUIDE TO INVESTING COURSE

FREE

GET TRADE ALERTS

Just $59/Month

Are you unable to find the time to build your own trading plans, do your own scans, or set up your own alerts? If so, our systems have you covered. Seize this opportunity to establish yourself as a consistent and disciplined trader and grow your trading account. Begin your journey today by subscribing to the RLT Newsletter.

MONEY MAKING BLOGS

Market Milestones: The Razor's Edge

The past two weeks have felt like the world is unraveling as volatility surges and the markets finally experience real selling. Many high-flying momentum names like PLTR and APP have been slammed back down to earth, shedding 35% to 50% in a matter of days. Yet, despite the chaos, the SPY is only 7% off its all-time highs and resting on its 200-day SMA. The drop feels steeper because that 7% decline happened in just 15 trading days, with barely any relief from the selling.

SPY

The Magnificent 7, which we track closely, has been hit even harder, with many of our favorite stocks down 20% from their highs—TSLA and NVDA even more so. I’ve felt the palpable fear of this market firsthand as bounces never materialize and every level I expect to act as support gets sliced and diced immediately, as if the market were auditioning for a roll as Ghostface with a freshly sharpened blade. Many positions have hit stops or protection zones as tech stocks free fall. But despite the fear—or rather, because of it—the risk-reward setup at this moment is one of the best we’ve seen in months. Fear creates opportunity, and the more I analyze the charts, the clearer this potential opportunity becomes.

MAGS

It’s easy to forget the following principle when panic is in the air, but it remains true and is fundamental to good investing and swing trading: To outperform in the market, you must embrace the opportunities that fear creates, buy into the biggest dips, and aggressively manage your downside risk.

We haven’t seen this level of fear or risk-reward since August 5th. Buying then felt insane—the news was bad, the gaps were brutal, and the market looked like it was in free fall. But with a solid risk mitigation plan in place, the worst-case scenario was already accounted for. Instead of financial ruin, the worst-case was simply losing small if stops or protective puts triggered. But they didn’t. Instead, the market reversed, kicking off a relentless four-month rally that took us to many new highs.

The market is currently standing at a crossroads. Will the bulls regain control over this market or has the economic, and macro picture changed enough that it is finally the bears time to shine? The SPY and QQQ are both at their 200-day SMAs, key levels they haven’t touched since late 2023. The QQQ actually closed below this level on Thursday, breaking through Tuesday’s candle in a way that it really shouldn’t have. This raises the risk in the market and puts some fairly bearish scenarios on the table. However, it also allows for some stellar risk-reward opportunities for those willing and bold enough to grab this knife. For example, if QQQ drops to $484.00—where both the bull market trendline and a strong horizontal support lie—it would be 10% off its all-time highs and offer a 12% move back into new highs with a 3.5% downside risk. Individual big tech names present even better setups, as stocks like AMZN are sitting on key levels that could either trigger a small bounce, a large bounce, or a quick and small stop-out.

QQQ

The Dollar is finally falling back to earth, which should be a positive catalyst for both equities and Bitcoin. Meanwhile, Bitcoin has held up relatively well, at least so far, despite what was a fairly predictable "sell the news" event on Thursday night. For more insights on Bitcoin, key price levels, and the potential impact of the Strategic Bitcoin Reserve on our favorite cryptocurrency, be sure to subscribe to our RLT Newsletter and join the discussion in our Slack channel!

DXY

Once again, this is a pivotal moment for the market as it stands on the razors edge. It’s oversold and looks primed for a bounce—even if only a short-lived one—but at the same time, it's teetering on the edge of triggering larger-scale bearish signals. Either support holds, leading to another grind higher, or we break down, opening the door for a much deeper flush. The key takeaway is that a strong bullish risk-reward setup is in place. By managing risk aggressively, one can position for the next major move, whether it's up or down. Worst case, support fails, which would lead to a small controlled loss. Best case, we see a meaningful bounce, allowing for collars to be put on longs, locking in risk-free trades into April. No matter what, staying sharp, adaptable, and prepared for the inevitable volatility will be key in navigating this unpredictable, news-driven market.

Market Milestones: The Razor's Edge

The past two weeks have felt like the world is unraveling as volatility surges and the markets finally experience real selling. Many high-flying momentum names like PLTR and APP have been slammed back down to earth, shedding 35% to 50% in a matter of days. Yet, despite the chaos, the SPY is only 7% off its all-time highs and resting on its 200-day SMA. The drop feels steeper because that 7% decline happened in just 15 trading days, with barely any relief from the selling.

SPY

The Magnificent 7, which we track closely, has been hit even harder, with many of our favorite stocks down 20% from their highs—TSLA and NVDA even more so. I’ve felt the palpable fear of this market firsthand as bounces never materialize and every level I expect to act as support gets sliced and diced immediately, as if the market were auditioning for a roll as Ghostface with a freshly sharpened blade. Many positions have hit stops or protection zones as tech stocks free fall. But despite the fear—or rather, because of it—the risk-reward setup at this moment is one of the best we’ve seen in months. Fear creates opportunity, and the more I analyze the charts, the clearer this potential opportunity becomes.

MAGS

It’s easy to forget the following principle when panic is in the air, but it remains true and is fundamental to good investing and swing trading: To outperform in the market, you must embrace the opportunities that fear creates, buy into the biggest dips, and aggressively manage your downside risk.

We haven’t seen this level of fear or risk-reward since August 5th. Buying then felt insane—the news was bad, the gaps were brutal, and the market looked like it was in free fall. But with a solid risk mitigation plan in place, the worst-case scenario was already accounted for. Instead of financial ruin, the worst-case was simply losing small if stops or protective puts triggered. But they didn’t. Instead, the market reversed, kicking off a relentless four-month rally that took us to many new highs.

The market is currently standing at a crossroads. Will the bulls regain control over this market or has the economic, and macro picture changed enough that it is finally the bears time to shine? The SPY and QQQ are both at their 200-day SMAs, key levels they haven’t touched since late 2023. The QQQ actually closed below this level on Thursday, breaking through Tuesday’s candle in a way that it really shouldn’t have. This raises the risk in the market and puts some fairly bearish scenarios on the table. However, it also allows for some stellar risk-reward opportunities for those willing and bold enough to grab this knife. For example, if QQQ drops to $484.00—where both the bull market trendline and a strong horizontal support lie—it would be 10% off its all-time highs and offer a 12% move back into new highs with a 3.5% downside risk. Individual big tech names present even better setups, as stocks like AMZN are sitting on key levels that could either trigger a small bounce, a large bounce, or a quick and small stop-out.

QQQ

The Dollar is finally falling back to earth, which should be a positive catalyst for both equities and Bitcoin. Meanwhile, Bitcoin has held up relatively well, at least so far, despite what was a fairly predictable "sell the news" event on Thursday night. For more insights on Bitcoin, key price levels, and the potential impact of the Strategic Bitcoin Reserve on our favorite cryptocurrency, be sure to subscribe to our RLT Newsletter and join the discussion in our Slack channel!

DXY

Once again, this is a pivotal moment for the market as it stands on the razors edge. It’s oversold and looks primed for a bounce—even if only a short-lived one—but at the same time, it's teetering on the edge of triggering larger-scale bearish signals. Either support holds, leading to another grind higher, or we break down, opening the door for a much deeper flush. The key takeaway is that a strong bullish risk-reward setup is in place. By managing risk aggressively, one can position for the next major move, whether it's up or down. Worst case, support fails, which would lead to a small controlled loss. Best case, we see a meaningful bounce, allowing for collars to be put on longs, locking in risk-free trades into April. No matter what, staying sharp, adaptable, and prepared for the inevitable volatility will be key in navigating this unpredictable, news-driven market.

ABOUT REAL LIFE TRADING

We are a stock trading education company. Our goal is to teach and empower people to create generational wealth to enrich their lives and communities.

ONLINE TRAINING LINKS