START TRADING WITH CONFIDENCE

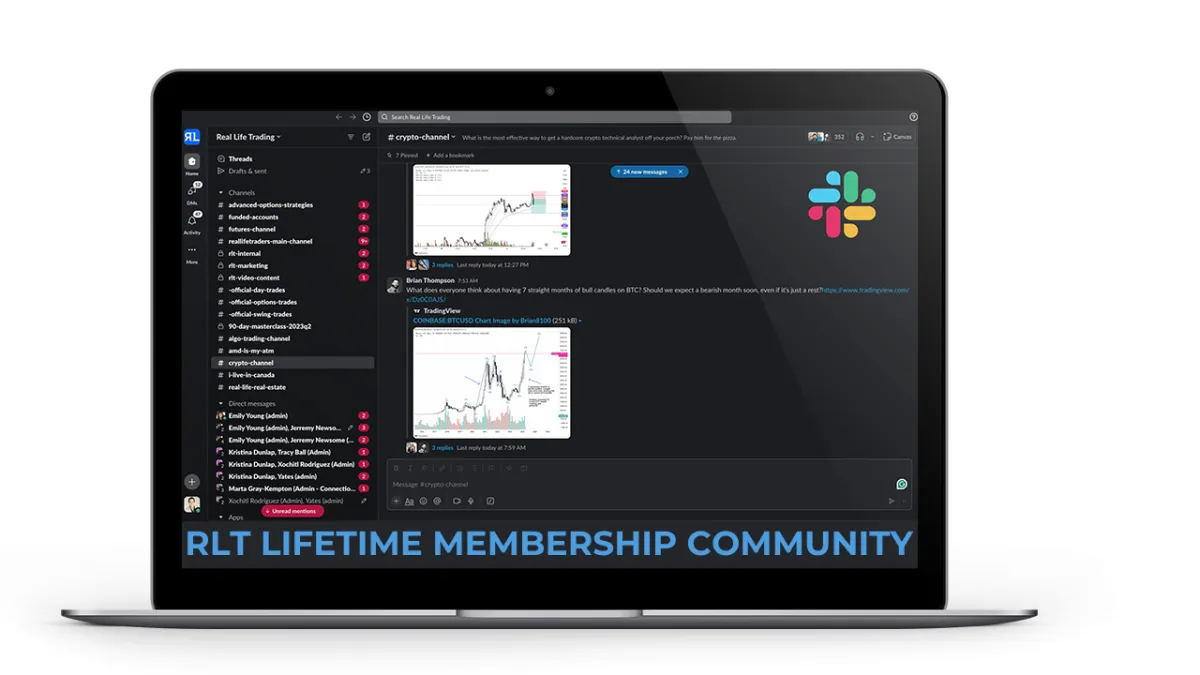

JOIN A COMMUNITY COMMITTED TO YOUR SUCCESS

Are you new to trading and ready to make your mark? Or do you have experience but are struggling to become a consistently profitable trader?

Imagine having a community of like-minded traders and experts at your side, helping you navigate every step of the journey!

Join us and gain lifetime access to our exclusive Slack community—where you’ll find real-time support, valuable insights, and camaraderie with fellow traders. With FREE monthly courses and weekly live education sessions, we’re here to guide you every step of the way. Whether you're just starting out or looking to enhance your skills, you’ll have the tools and community you need to trade with confidence.

Start your journey today with a community dedicated to your success with a one-time $25 investment!

CREATE CASH FLOW AND KEEP IT

RETIRE EARLY AND LIVE THE LIFE YOU WANT

We teach people how to make money from the stock and crypto markets and KEEP IT by following simple and proven strategies that have generated $10,000,000+ for our customers and their families.

Tired of working for someone else? Dream of trading full-time?

Now’s your chance to make it happen!

Become a Full-Time Trader in 2025 with Tony Pawlak's

Elite 10-Month Premier Coaching Program !

Registration Only Opened Once a Year!

This isn’t just another program —

it’s a proven pathway to success. Over the years, Tony has helped countless students quit their jobs and transition into full-time trading. Through personalized coaching and hands-on training, he will guide you step by step to ensure you not only learn, but master the essential skills needed to consistently win in the markets.

AS FEATURED IN

Want to Trade LIVE with other TRADERS?

Get signed up for our immersive, high-energy, active stock trading rooms.

You'll get detailed insights on entries, exits, targets, and explanations.

We answer viewer questions in real time.

Get All Access to All Live Trading Rooms + Slack + RLT Newsletter

Just $275/Month - Best Value

Real-time trades you can follow

Exclusive Weekly Mentorships

Expert 1:1 trading support on demand

Access to a private slack group

Access to an incredible community of RLT traders to support you on your journey

Get access to live day trade & swing trading rooms

Live practice sessions/drills and strategies + get real-time feedback

Live market recaps and analysis

Weekly Q&A session to review your trades and answer your trading questions.

RLT Newsletter with trade alerts, stock picks and market analysis

Live Day Trading Room

Just $179/Month

Real-time trades you can follow

Expert 1:1 trading support on demand

Access to an incredible community of RLT traders

Get access to our live day trading room

Live practice sessions/drills and strategies + get real-time feedback

Live market recaps and analysis

Live SWING Trading Room

Just $149/Month

Real-time trades you can follow

Expert 1:1 trading support on demand

Access to an incredible community of RLT traders

Get access to our live swing trading room

Live practice sessions/drills and strategies + get real-time feedback

Live market recaps and analysis

RLT Education Programs

Mentorships

Unlock Your Trading Potential with

Funded Trading

Do you have the skills to trade, but lack the capital to make your mark in the markets?

Funded trading could be the solution you've been waiting for. With funded trading, you can trade with the backing of a funding company who will provide you with the trading capital, allowing you to focus on your strategy without the burden of risking your own capital.

Apex Trader Funding was established in

2021 with the goal of revolutionizing the trader payout model. It was founded out of dissatisfaction with existing funding companies and a desire to adopt a more customer-centric approach. As a premier trader funding company, Apex Trader Funding (ATF) outperforms other futures funding evaluation firms in terms of payouts. With a vast global community spanning over 150 countries and tens of thousands of members, Apex Trader Funding, headquartered in Austin, Texas, specializes in funding evaluations for futures markets.

Receive 100% of the first $25,000 per Account and 90% Beyond That

Two Payouts per Month

Trade Full-Sized Contracts in Evaluations or Funded Accounts

No Scaling or Failing by Going Over Contract Size

No Daily Drawdowns

Trade on Holidays

Trade Your Normal Day-to-Day Strategy or System During The News

No Total Cap on Maximum Payout

One-Step Evaluation Process

Real-Time Data Included

Simple Risk Management Rules

Trade With Multiple Accounts up to 20 max

If you’re a trader with the knowledge and skill but are held back by limited capital, Apex Trader Funding offers you the chance to access the capital you need to trade confidently.

Join the revolution in trading today with Apex Trader Funding, where your potential is funded, and your success is our priority.

FREE TRADING RESOURCES

Take FREE online courses to learn how to earn extra income while keeping your day job, Paying off debt, investing in your future, and Retiring Early

BEGINNER GUIDE TO DAY TRADING COURSE

FREE

BEGINNER GUIDE TO SWING TRADING COURSE

FREE

BEGINNER GUIDE TO INVESTING COURSE

FREE

GET TRADE ALERTS

Just $59/Month

Are you unable to find the time to build your own trading plans, do your own scans, or set up your own alerts? If so, our systems have you covered. Seize this opportunity to establish yourself as a consistent and disciplined trader and grow your trading account. Begin your journey today by subscribing to the RLT Newsletter.

MONEY MAKING BLOGS

Market Milestones: Bye Bitcoin or Buy Bitcoin

It's been a while since we took an in-depth look at Bitcoin’s chart, and I think it’s time. We’re likely approaching one of the last solid risk-reward opportunities for longs in this cycle. A pullback to 100-day SMA, currently around $93,000, still offers a solid entry with roughly 30% upside to my lower target of $124,000. That level is a high-probability target for this cycle and provides the kind of setup I look for in position trades. It’s of course possible the DeepSeek low was the last dip we are going to get, and we blast off on a mission to the moon.

As far as targets go, I don’t think $124,000 will be the ultimate peak, it’s just a high probability target for this cycle. Bitcoin has yet to enter the euphoric phase of the cycle, and historically, its final fifth wave moves tend to extend—creating parabolic, blow-off tops that can be extremely rewarding for bulls. When that phase kicks in, we’ll start hearing even more wild seven-figure price targets, and the hype will be overwhelming, making it psychologically difficult to sell. That’s why it's crucial for traders to set targets now—at least for partial profit-taking.

Trading Around a Core Position

For me, selling Bitcoin is always a challenge because it remains one of the best-performing assets of all time. But trading around a core long-term position allows even the most bullish traders to take profits without fully exiting the market. The core position is held for the long term in case the most bullish scenario plays out, while profits on the rest of the position can be used to diversify into other assets, improve lifestyle, or—more often than not in my case—buy even more Bitcoin when the inevitable dip happens.

As traders and investors, we have to accept that we will never time the exact top. Some upside will always be left on the table. But securing profits at strategic levels ensures that if Bitcoin pulls back significantly or enters a prolonged bear market, you have capital ready to buy back at lower prices, ultimately increasing your Bitcoin holdings.

Bitcoin’s Post-Cycle Pullbacks & Future Targets

Bitcoin has a well-documented history of deep post-cycle pullbacks, often 70% or more. If history repeats, a cycle top in the $140,000–$175,000 range would imply a future low somewhere between $40,000–$60,000. A top above $140,000 would align well with the parallel channel Bitcoin has tracked since 2018, while a move to $200,000 would suggest a potential bottom closer to $60,000 during the next crypto winter.

While it’s possible that Bitcoin’s ETF-driven demand dampens some of the usual volatility—both to the upside and downside—I’m not ruling out another major correction in Bitcoin’s future. That’s why having an exit and re-entry plan matters.

BTCUSD Parallel Channel

Profit-Taking Strategies

There are two primary ways to take profits in Bitcoin, and both can be used together:

Setting limit sells at predetermined targets – Selling into strength is challenging because when Bitcoin is surging, it feels unstoppable. This can lead to FOMO as Bitcoin continues to climb past your sell target. However, unless you're a die-hard HODLer intending to pass your Bitcoin down through generations, taking profits along the way is a disciplined and wise strategy. Some Bitcoin maximalists might argue that you're exchanging "valuable" BTC for "worthless" fiat currency. Yet, if those worthless dollars enable you to accumulate even more BTC later, it’s a win-win.

Using trailing stops to lock in gains – Instead of selling into strength, this approach lets you sell on weakness, protecting profits in the case of larger downturns, while allowing Bitcoin to run higher if momentum continues. A simple way to implement this is by setting a trailing stop below a key moving average—such as the weekly or monthly 50-EMA. If Bitcoin extends into full-blown euphoria, this method helps to capture more upside and locks in gains once the uptrend weakens.

These two strategies can work in unison. Limit sells can lock in profits near expected resistance zones, while trailing stops help catch extended moves without selling too early.

Bitcoin in 2025

How high Bitcoin climbs this cycle will help determine where the next bear market bottom forms. If we see a blow-off top, the subsequent pullback could be steeper. If ETFs smooth out the market, we may not see the usual 70–80% crypto winter crashes. Either way, my approach for bitcoin for the year 2025 is as follows:

Buy dips into the mid to low $90,000s and potentially the $80,000s.

Lock in profits at predetermined targets in the $140,000–$175,000 range.

Hold a solid core position in bitcoin in case the mega bulls are right and we never dip again.

Stay patient and stay ready for anything.

Like many, I’ve been scaling into Bitcoin for the last several years, but we are now approaching the time to scale out as buy zones diminish. The key to success now is discipline—whether your plan is to HODL through whatever this market brings or to take profits at key levels, the most important thing is sticking to that plan. Avoiding emotional decisions and staying committed to a well-thought-out strategy is what separates successful traders and investors from those who get caught chasing hype or panic-selling at the worst times.

This cycle still has room to run, but the window for strong risk-reward buys is closing, or perhaps closed. Now, it’s about execution—being patient, taking profits when targets hit, and planning for the next move, whatever that may be.

BTCUSD Fifth Wave

Market Milestones: Bye Bitcoin or Buy Bitcoin

It's been a while since we took an in-depth look at Bitcoin’s chart, and I think it’s time. We’re likely approaching one of the last solid risk-reward opportunities for longs in this cycle. A pullback to 100-day SMA, currently around $93,000, still offers a solid entry with roughly 30% upside to my lower target of $124,000. That level is a high-probability target for this cycle and provides the kind of setup I look for in position trades. It’s of course possible the DeepSeek low was the last dip we are going to get, and we blast off on a mission to the moon.

As far as targets go, I don’t think $124,000 will be the ultimate peak, it’s just a high probability target for this cycle. Bitcoin has yet to enter the euphoric phase of the cycle, and historically, its final fifth wave moves tend to extend—creating parabolic, blow-off tops that can be extremely rewarding for bulls. When that phase kicks in, we’ll start hearing even more wild seven-figure price targets, and the hype will be overwhelming, making it psychologically difficult to sell. That’s why it's crucial for traders to set targets now—at least for partial profit-taking.

Trading Around a Core Position

For me, selling Bitcoin is always a challenge because it remains one of the best-performing assets of all time. But trading around a core long-term position allows even the most bullish traders to take profits without fully exiting the market. The core position is held for the long term in case the most bullish scenario plays out, while profits on the rest of the position can be used to diversify into other assets, improve lifestyle, or—more often than not in my case—buy even more Bitcoin when the inevitable dip happens.

As traders and investors, we have to accept that we will never time the exact top. Some upside will always be left on the table. But securing profits at strategic levels ensures that if Bitcoin pulls back significantly or enters a prolonged bear market, you have capital ready to buy back at lower prices, ultimately increasing your Bitcoin holdings.

Bitcoin’s Post-Cycle Pullbacks & Future Targets

Bitcoin has a well-documented history of deep post-cycle pullbacks, often 70% or more. If history repeats, a cycle top in the $140,000–$175,000 range would imply a future low somewhere between $40,000–$60,000. A top above $140,000 would align well with the parallel channel Bitcoin has tracked since 2018, while a move to $200,000 would suggest a potential bottom closer to $60,000 during the next crypto winter.

While it’s possible that Bitcoin’s ETF-driven demand dampens some of the usual volatility—both to the upside and downside—I’m not ruling out another major correction in Bitcoin’s future. That’s why having an exit and re-entry plan matters.

BTCUSD Parallel Channel

Profit-Taking Strategies

There are two primary ways to take profits in Bitcoin, and both can be used together:

Setting limit sells at predetermined targets – Selling into strength is challenging because when Bitcoin is surging, it feels unstoppable. This can lead to FOMO as Bitcoin continues to climb past your sell target. However, unless you're a die-hard HODLer intending to pass your Bitcoin down through generations, taking profits along the way is a disciplined and wise strategy. Some Bitcoin maximalists might argue that you're exchanging "valuable" BTC for "worthless" fiat currency. Yet, if those worthless dollars enable you to accumulate even more BTC later, it’s a win-win.

Using trailing stops to lock in gains – Instead of selling into strength, this approach lets you sell on weakness, protecting profits in the case of larger downturns, while allowing Bitcoin to run higher if momentum continues. A simple way to implement this is by setting a trailing stop below a key moving average—such as the weekly or monthly 50-EMA. If Bitcoin extends into full-blown euphoria, this method helps to capture more upside and locks in gains once the uptrend weakens.

These two strategies can work in unison. Limit sells can lock in profits near expected resistance zones, while trailing stops help catch extended moves without selling too early.

Bitcoin in 2025

How high Bitcoin climbs this cycle will help determine where the next bear market bottom forms. If we see a blow-off top, the subsequent pullback could be steeper. If ETFs smooth out the market, we may not see the usual 70–80% crypto winter crashes. Either way, my approach for bitcoin for the year 2025 is as follows:

Buy dips into the mid to low $90,000s and potentially the $80,000s.

Lock in profits at predetermined targets in the $140,000–$175,000 range.

Hold a solid core position in bitcoin in case the mega bulls are right and we never dip again.

Stay patient and stay ready for anything.

Like many, I’ve been scaling into Bitcoin for the last several years, but we are now approaching the time to scale out as buy zones diminish. The key to success now is discipline—whether your plan is to HODL through whatever this market brings or to take profits at key levels, the most important thing is sticking to that plan. Avoiding emotional decisions and staying committed to a well-thought-out strategy is what separates successful traders and investors from those who get caught chasing hype or panic-selling at the worst times.

This cycle still has room to run, but the window for strong risk-reward buys is closing, or perhaps closed. Now, it’s about execution—being patient, taking profits when targets hit, and planning for the next move, whatever that may be.

BTCUSD Fifth Wave

ABOUT REAL LIFE TRADING

We are a stock trading education company. Our goal is to teach and empower people to create generational wealth to enrich their lives and communities.

ONLINE TRAINING LINKS